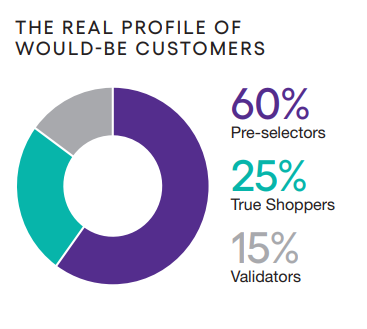

For many consumer goods and retail businesses, more than half of prospective customers have already made up their mind about what they intend to buy before they even recognized the need to purchase.

This was especially true of the $1 trillion North American grocery market pre-pandemic. Among would-be grocery shoppers, we would typically see that 60% had preselected their grocery retailer, 15% were looking to validate the retailers they were already familiar with, and 25% were actually True Shoppers—customers who were open to marketing that could sway their decision.

However, nothing shakes up the old way of doing things like a global pandemic with a side of uncertainty, which did a lot to shift brand loyalties in grocery retail. My hypothesis is that everyone became a True Shopper during this time because everyone was facing shortages across their neighborhood grocery retailers.

In the pre-pandemic grocery market, most consumers were brick-and-mortar shoppers. These shoppers went to their neighborhood grocery and big box stores out of habit. We call these people Pre-selectors. However, COVID-19 shifted consumer behavior practically overnight. When the pandemic hit, Pre-selectors were suddenly catapulted into becoming True Shoppers because the stores they shopped simply didn’t have the products they needed on the shelves. The consumer to trusted retailer connection was suddenly broken. Loyal shoppers were forced to find new avenues to access food supplies and basic needs such as bread and toilet paper. Choice was limited and finding groceries at locations where the product was in stock became the priority.

While this phenomenon created chaos in grocery stores across the country, it also created opportunity and overnight demand for online grocery delivery services, which has now forever changed the shopper journey. Instead of the one-shopper-to-one-store relationship that existed in the past, online grocery services created a one-shopper-to-many-stores relationship. It also saved shoppers from driving around to different stores, looking for out-of-stock products. Suddenly, online grocery enabled shoppers to search many stores from the safety of home via an app. This gave shoppers the ability to search for the products they needed across multiple grocery retailers at the same time, locate what was in stock, and have those products safely delivered to them within hours. The one-shopper-to-many-stores capability revolutionized the shopping experience and shifted grocery shopping behavior and shoppers’ path-to-purchase faster than any other time in modern history.

The surge in adoption for online grocery shopping drove a significant increase in market penetration for companies such as Instacart and Peapod while further paving the way for Walmart and Target to quickly develop or optimize their online shopping services and curbside pickup options. Suffice to say, the retailers who innovated capitalized on this shift, attracted customer growth, and grew their brand.

A Changing Consumer Journey: What’s Next for Grocery Retailers?

In a market where most of the pie of prospective customers is going back to Pre-selectors and Validators dominating the shopping experience, it is a critical moment to review the unique path to purchase for your brand and adjust your strategy for expanding market share.

While things are mostly back to “normal” and despite supply chain issues and other economic factors, habits have changed and consumer behaviors have shifted. It’s unlikely Pre-selectors prior to the pandemic have gone back to all the same retailers—more likely they’ve mixed in old behaviors with new behaviors and shifted their retailer loyalties. They’re likely Pre-selectors again, but somewhere along the way they were forced to shop, they became aware of other options, they considered their options, and now they’ve shifted for good.

My point is, with all this change, there is new opportunity for retailers to grow your customer base by refreshing and updating your consumers’ path to purchase. In a world where preselection dominates buying decisions, effective marketers must extend their focus to the top of the funnel. It’s a crucial vantage point—one that enables marketers to see the true friction points in their customer-acquisition process and identify strategies and adjust marketing strategies to win more customers.

Since 2016, we have been using our award-winning path-to-purchase approach to help companies accurately assess their markets and upgrade their competitive positioning with prescriptive insights driven by behavioral science. While our Pre-selector, Validator and True Shopper framework was rooted in bigger-ticket items, it holds true for grocery retailers and for product brands alike, keeping in mind that the relationship between the customer, the retailer and the brands they offer have a compounding effect.

Need Help Mapping Out Your Purchase Journey?

Our Path to Purchase (P2P) customized research, analyses and recommendations provide the information and implementation tools needed to grow. For more information, download Want to Win More? Your Guide to Boosting Customer Growth Using Our Award-Winning Path-to-Purchase Approach.