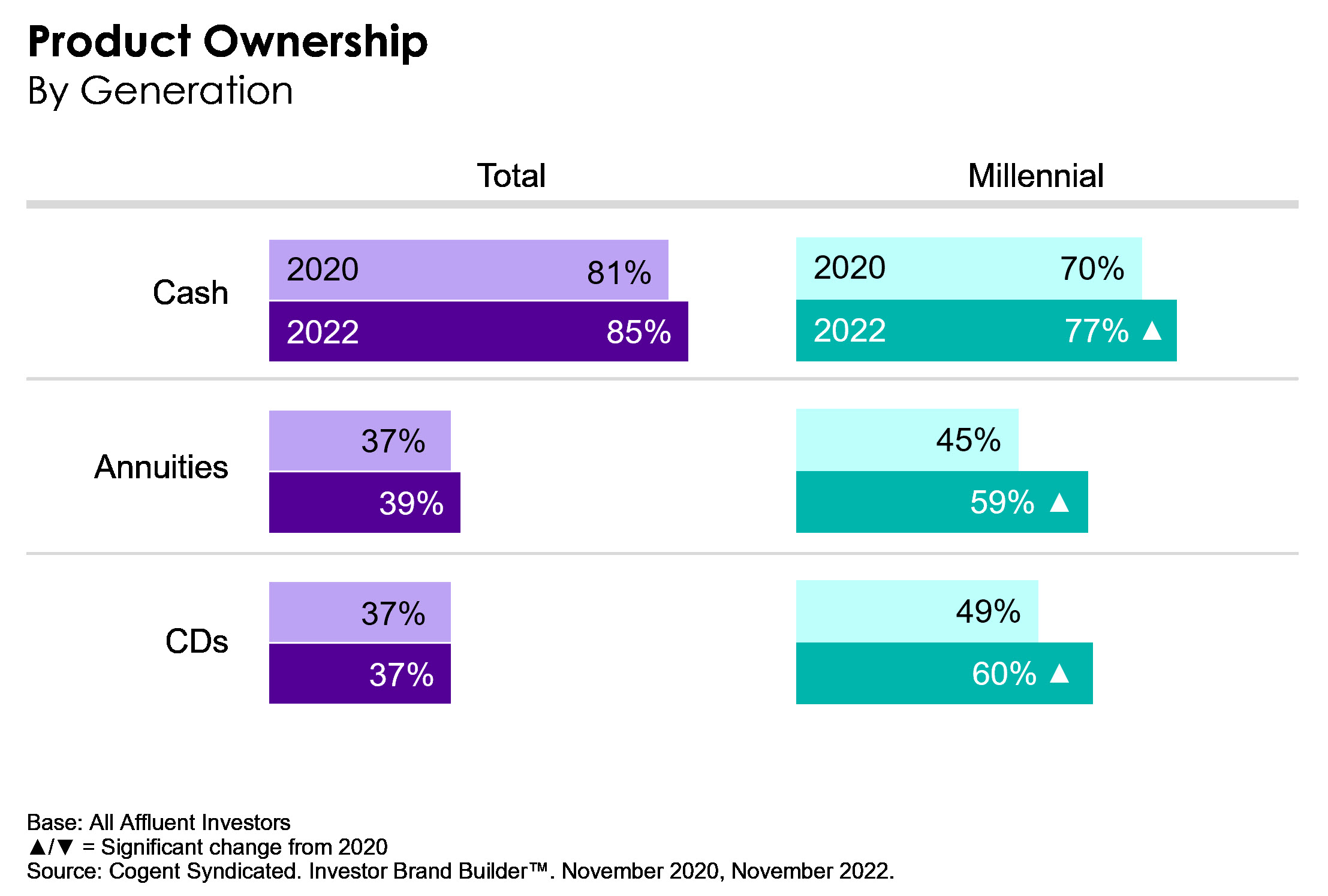

Eight successive increases in the federal funds rate since March of last year, combined with the double-digit decline in equity markets, are refueling investors’ interest in annuities. During volatile and inflationary times, investors look to these traditionally unexciting products designed to offer principal protection and growth potential. Unsurprisingly, many investors approaching retirement easily see benefits in products that offer a guaranteed income stream in their retirement years. However, Cogent Syndicated’s research among affluent investors finds that younger generations, particularly millennials, are also showing increased interest in annuities. While ownership of annuities and CDs is stable overall, millennial ownership of both of these product types is up significantly over the past two years.

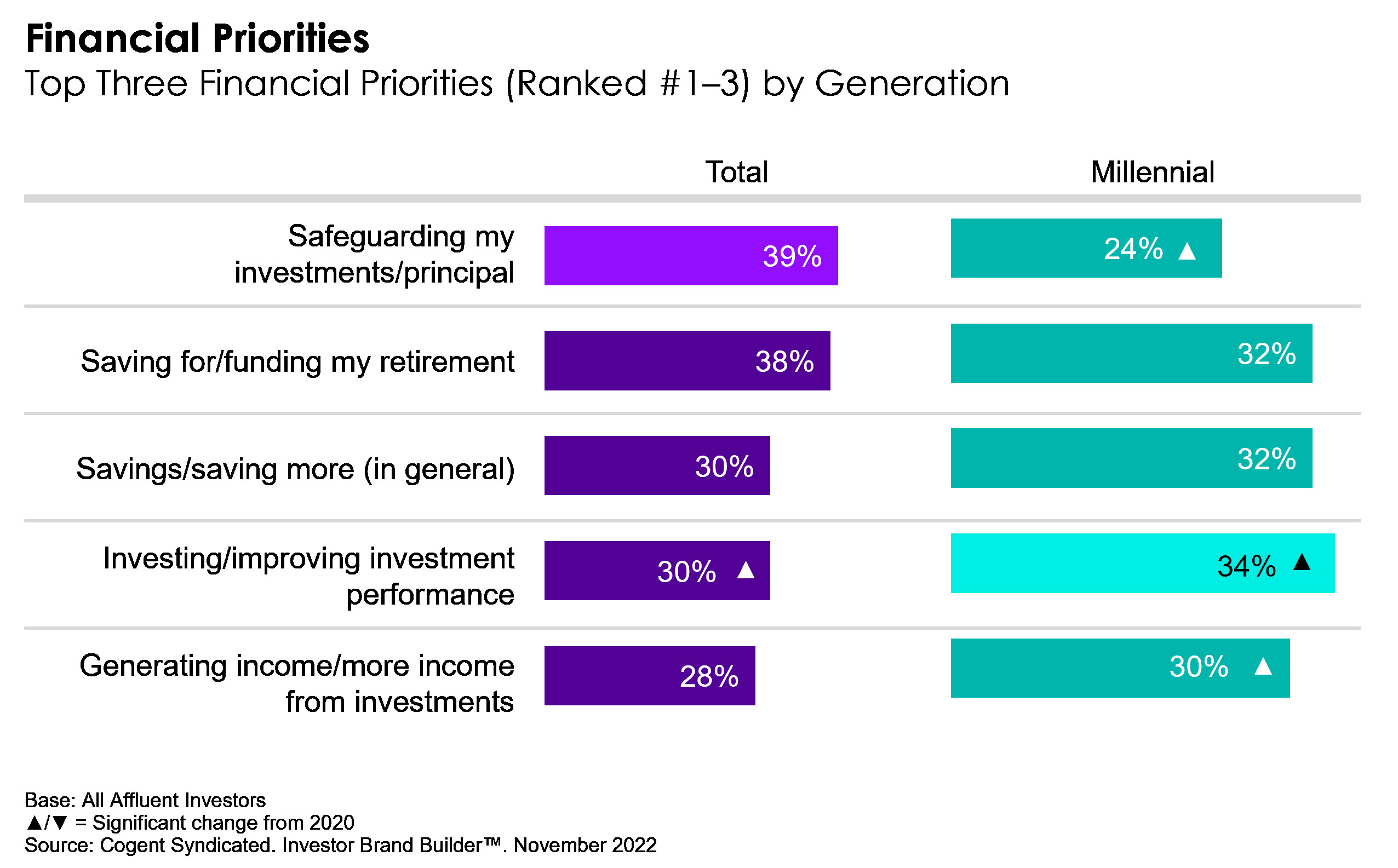

And when it comes to financial priorities, safeguarding principal runs neck and neck with saving for retirement as the top-ranking financial goal among affluent investors overall, but among millennials, improving investment performance is the top financial priority, up significantly over the past two years.

As interest in annuities has grown, so too has our clients’ desire to understand the consumers showing increasing interest in life products and the agents and brokers that many insurers distribute through. In response, our financial services research teams have focused on helping our clients in three broad areas. These research efforts all support our clients’ primary goal of maximizing their business during this time of heightened demand.

1: Producer Engagement

Most carriers have many more appointed agents than active producers, and encouraging agents to start selling or sell more life insurance and annuity products has long been a challenge, as it requires these agents sell beyond their traditional car and homeowner’s insurance policies. But because these products are now in greater demand, it’s critical to understand how retail and wholesale partners think about annuities, uncover the barriers to use that may need to be overcome, and develop innovative approaches to providing sales support that encourages agent sales and/or referrals. Our dedicated qualitative research team routinely engages with hard-to-reach producer audiences to explore unmet needs and wants and determine how best to get agents to ask about a life insurance or annuity product as part of an auto and/or homeowner’s insurance conversation, for example.

2: Product Innovation

There have been significant developments in the annuity market since 2008 that have targeted some of the traditional concerns with the category: annuities are costly, investors miss out on market booms, and annuitization is counter to bequest motives. With these challenges in mind, we’ve helped clients through the full innovation journey by helping them find white space and assess the market opportunity, then create and evaluate new concepts, and finally optimize and message new or improved product offerings.

3: Messaging

A key consideration for annuity sales is understanding how to frame the product purchase decision. Our behavioral sciences team examines the impact of how the products are often framed in marketing messages—whether positively promoting “peace of mind,” for example, or negatively framing the product benefits as a means to avoid negative consequences such as outliving one’s assets. Understanding what motivates different consumers and how their motives may vary by age, marital status, net wealth, existence of children and/or grandchildren, etc., is important in determining which type of annuity best fits each client’s needs, and how best to communicate the features and benefits to each client.

With so much change in the markets, it’s clear investors of all ages are looking for some kind of solid ground. While annuities may once have been considered “boring”, consumers and advisors alike are now seeing them as a way to safeguard investments for retirement while other investment vehicles continue to bounce around in the volatile market. But to capture a share of the increased demand, it’s imperative for brands to know how to engage their agents, innovate new products to meet changing needs and create messages that resonate to capitalize on the opportunity.

Want to understand consumer demand and navigate market opportunities?