The alternative investments market continues to expand, driven by investors’ pursuit of diversification and enhanced returns. With financial innovation and regulatory changes making alternative investments more accessible, new products, investment themes and asset classes are beginning to appear. Understanding how advisors view and use the products available to them is key to successful positioning and future growth. Cogent Syndicated’s latest Trends in Alternative Investments™ report, which published in April, measures both advisor and accredited investor interest in alternatives to help firms identify barriers and drivers to use of alternative investments and project future growth of the category. Read on for a taste of our top-level findings.

Provider Selection: Beyond Performance and Transparency

While investment performance and transparency remain top priorities, ease of access and implementation are increasingly important for advisors—even more so than manager brand reputation. As points of access for alternative investments grow, addressing advisor needs and concerns will be key.

Some of the top barriers to entry noted by advisors are lack of liquidity and high fees (56% and 46%, respectively). However, advisors voice increasing concerns over a heavy administrative/operational burden (from 23% in 2024 to 36% in 2025). As product and platform innovations continue to shape offerings in this space, addressing the operational and administrative burdens facing advisors will be critical to enabling broader access and improving scalability.

Growing Familiarity and Sustained Interest

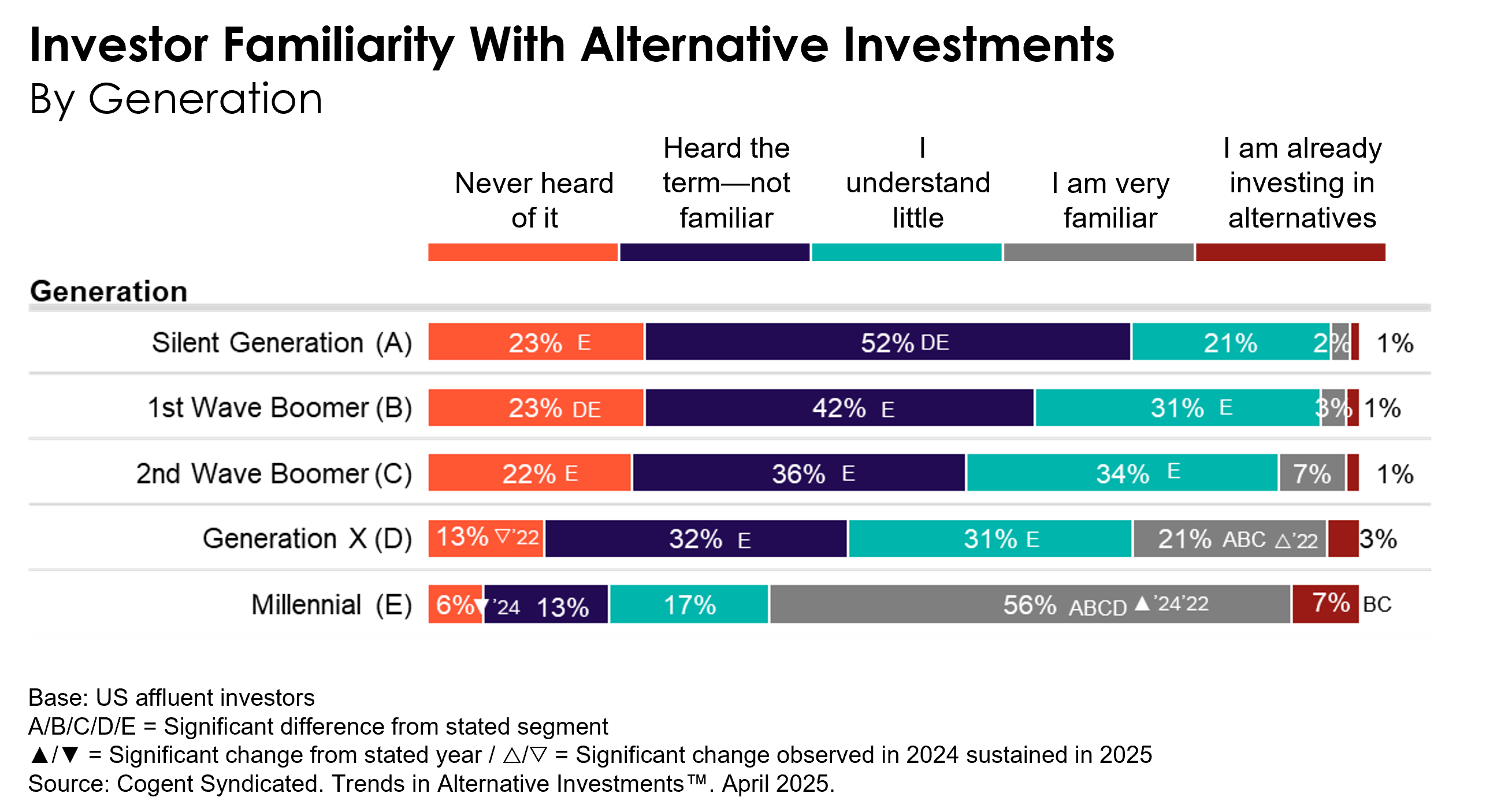

Investor familiarity with alternatives has grown markedly, with 19% now considering themselves very familiar (up from 14% a year ago). This surge is most pronounced among Millennials, 56% of whom report high familiarity, up significantly from a year ago. Gen X investors are also reporting higher levels of familiarity and interest.

The Enduring Influence of Financial Advisors

Financial advisors continue to shape the alternative investment narrative. Advised investors are significantly more likely to be knowledgeable about, own and allocate greater portions of their portfolios to alternatives than self-directed investors.

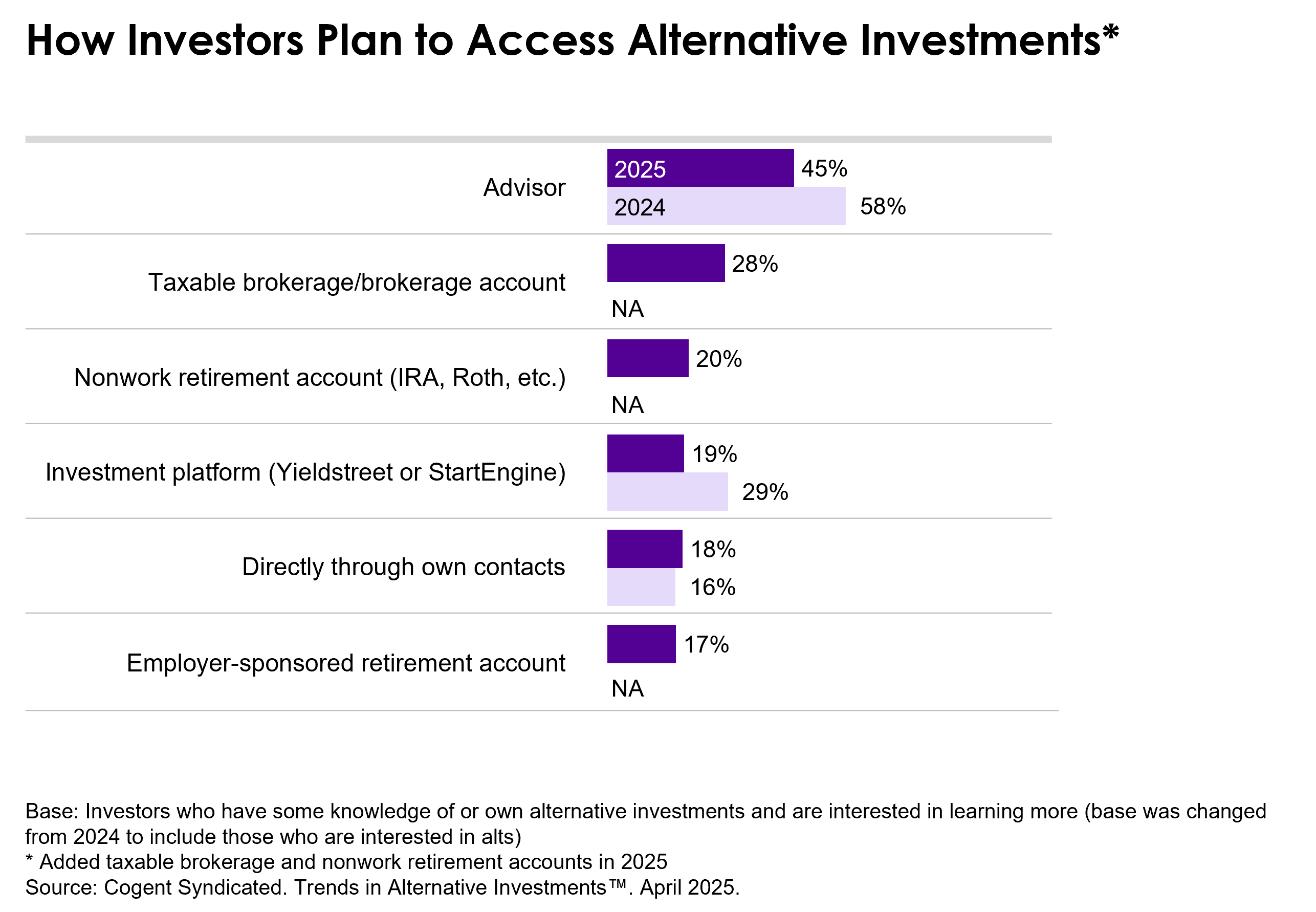

Financial advisors also remain the primary access point for alternative investments. A small minority of investors (19%) use investment platforms like Yieldstreet or StartEngine, and just 18% invest directly through personal contacts. Notably, investors report growing interest in accessing alternatives via employer-sponsored retirement plans—17% of all investors and 31% of Millennials express interest, signaling potential for future growth in this channel.

The alternative investments landscape is evolving rapidly, driven by shifting advisor philosophies, growing familiarity among investors (especially Millennials) and the expanding availability of liquid and accessible products. As market dynamics and investor preferences continue to evolve, financial advisors will remain at the center of this transformation, guiding clients through the complexities and opportunities of the alternatives universe.

To learn more about the full Trends in Alternative Investments report, click below.