Advisors are increasingly going up market and considering how to best serve more affluent clients. To some extent, that’s having an impact on their use of model portfolios. Once a solution that was seeing rapid growth year-over-year, this year we’re seeing a leveling off in the adoption of model portfolios.

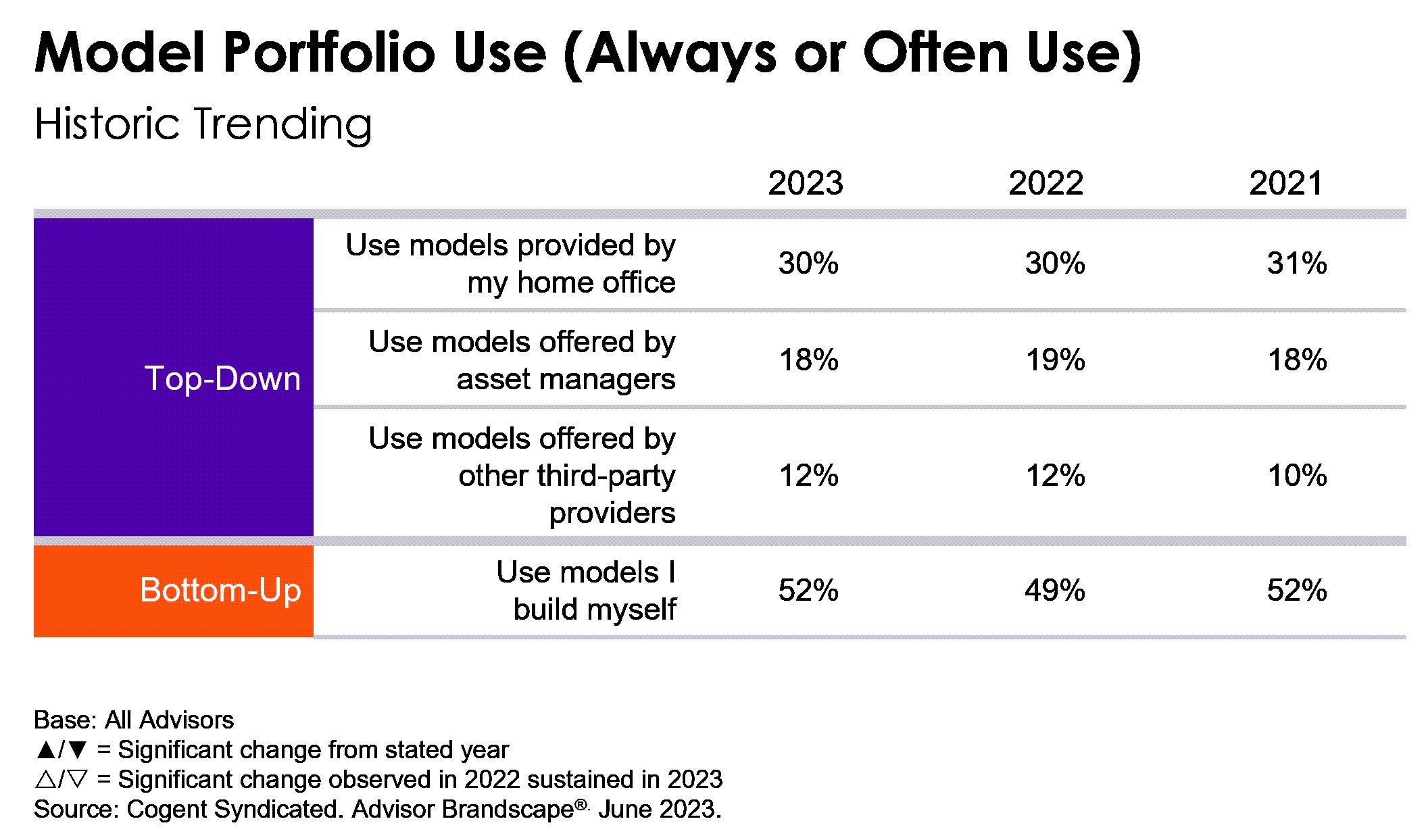

Contrary to industry expectations that third-party model portfolio use is accelerating in the advisor community, in this year’s Advisor Brandscape report we actually observed a leveling off in adoption. Just more than half of advisors (52%) continue to always or often use models that they create or modify themselves, which speaks to the continued importance of portfolio construction tools and support.

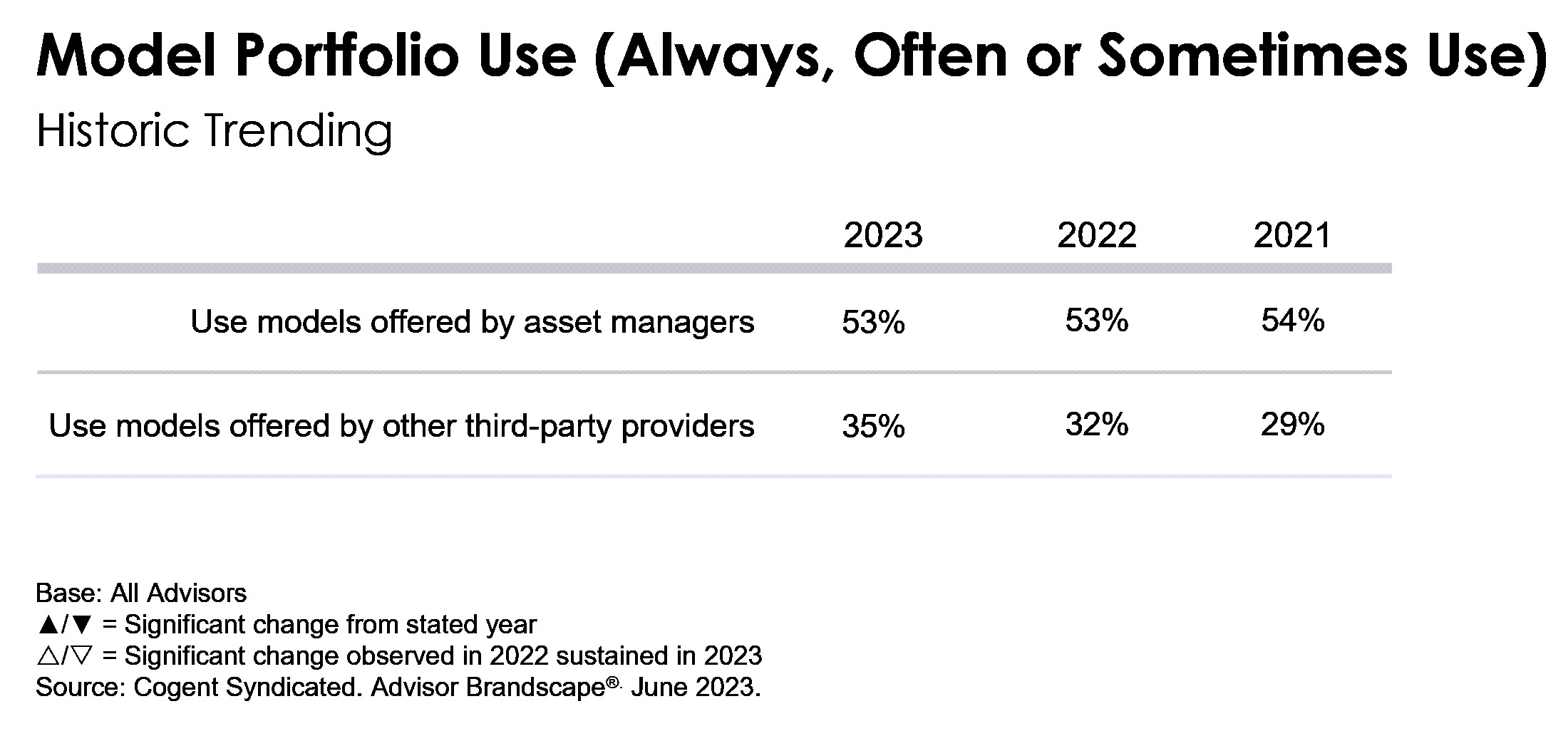

When we expand to include the types of models that they sometimes use, the picture does change a bit. The use of models from asset managers has held steady at 53%, with not much change over the last three years. However, we are seeing some directional uptick in the use of models offered by other third-party providers, or TAMPS, up from 29% in 2021 to 35% in 2023, with more advisors saying they sometimes use these products.

When asked what he thought might be contributing to these trends in a recent webinar with Cogent, my colleague Will Trout of Javelin Strategy & Research commented, “I wonder if some of this growth in the use of models may be attributable to the organic growth of the RIA business. More RIAs, more individual advisors, and small practices are looking for these models. But … advisors are not using these models, necessarily, for their largest clients. The signal trend in the industry from a product and solutions standpoint today is personalization, and I just wonder if these advisors feel like these kinds of models have a little bit of ‘store bought’ sense to them.”

And I tend to agree. Even if it’s just the perception or the stigma that these products are an off the shelf solution, even though that’s not always the case, advisors could be feeling that and deciding they’re not suitable for their more affluent clients.

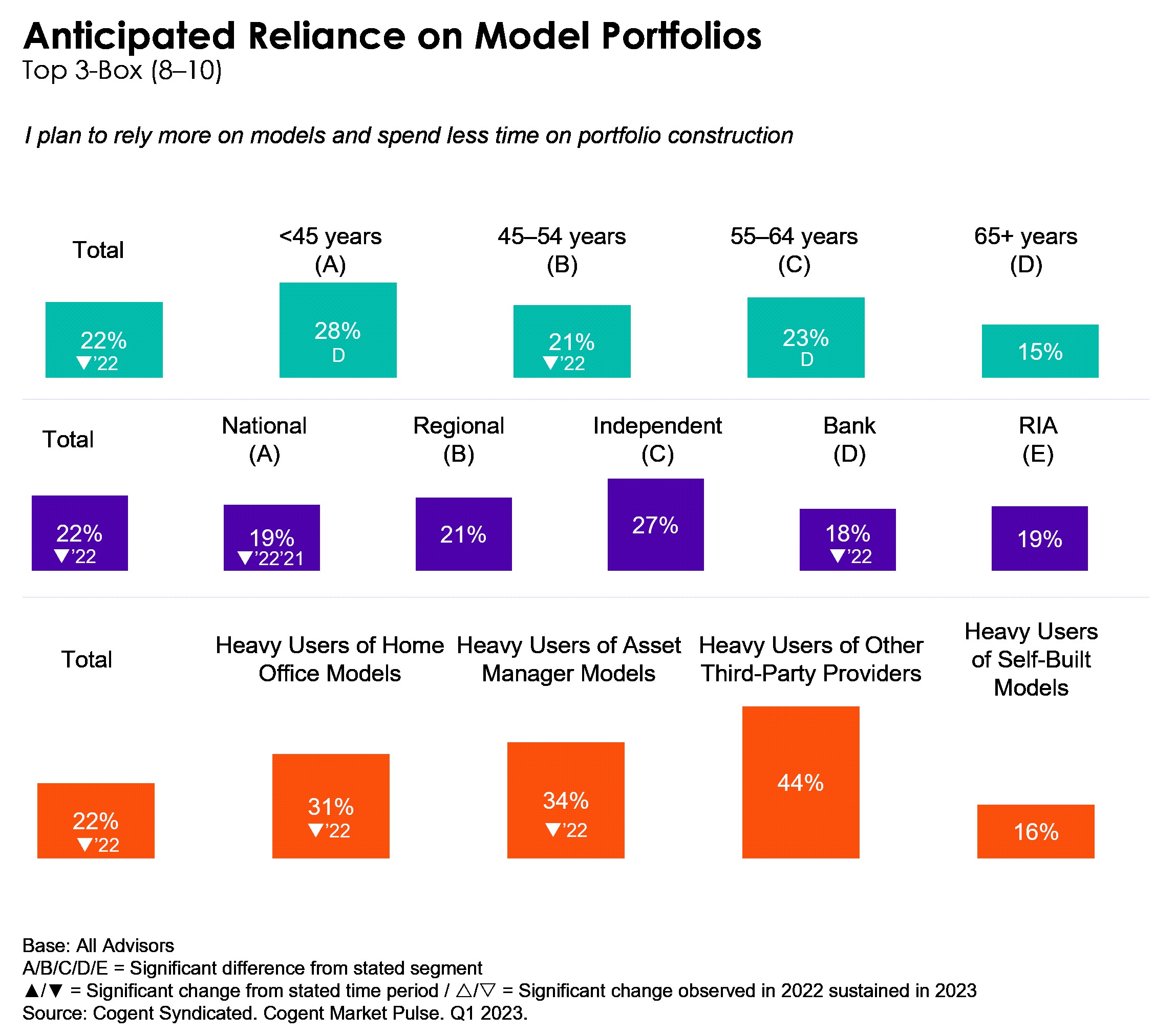

Further supporting this slowing in the adoption of model portfolios, another question asked in Advisor Brandscape seeks to understand the future use of these solutions. In contrast to last year when we saw some momentum building, we actually saw some decline in advisors’ anticipated reliance on model portfolios. Just over one in five (22%) advisors indicated that they expect to rely more on model portfolios over the next year compared with 27% last year. This decline is primarily being driven by advisors in the National and Bank channels as well as heavy users of home office and asset manager models.

What does it all mean? The challenge for model portfolio providers and for asset managers offering these tools to overcome some of these barriers to use is to address perceptions that model portfolios don’t deliver sufficient value for the money or aren’t sophisticated enough for more affluent clients.

To see more from Advisor Brandscape and changes among the advisor population, watch a replay of our webinar, “New Insights on Advisor Trends”.