Mass vaccination efforts in the US in the first half of the year resulted in advisors becoming less concerned about the economic impact of the pandemic. However, advisors’ concerns about infectious diseases reemerged in July as COVID-19 variants continued to spread, threatening a global economic recovery. As cities reinstate mask mandates, businesses again struggle to stay open, and eased restrictions are back in place, advisors and investors are less optimistic the US economy will improve over the next three months.

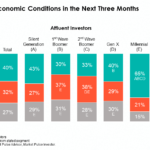

In July, 30% of financial advisors predicted the economy will improve in the next three months, a steep decline since March, when two-thirds (66%) of advisors predicted conditions would improve. Meanwhile, affluent investors are relatively more optimistic than advisors, with 40% anticipating the US economy will improve in the next three months. Notably, Millennial investors are significantly more optimistic than their older peers, with two-thirds (65%) predicting conditions will improve over the next three months.

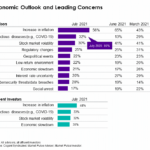

This time last year, COVID-19 consumed the attention of everyone, including advisors’ and affluent investors’. In July 2020, four in ten (42%) advisors ranked infectious diseases (e.g., COVID-19) as the greatest threat to the health of their clients’ portfolios, with four in five (80%) ranking it among their top three concerns. Other leading concerns at the time were a potential global/economic recession and the upcoming presidential election, at 73% and 52%, respectively. Today, despite resurging concern around COVID-19, inflation stands out as financial advisors’ leading concern, with more than half (56%) concerned. Notably, few advisors (9%) ranked inflation among their top three concerns in July 2020. Similarly, affluent investors consider increasing inflation, infectious diseases (e.g., COVID-19) and stock market volatility as leading concerns about their investment health.

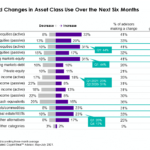

Looking ahead, advisors are most interested in actively managed equity funds and continue to rely less on passive US and non-US fixed income. To hedge against inflation, which is now their top concern, advisors continue to identify actively managed non-US equity funds and emerging market equities as undervalued investment opportunities and are increasingly interested in alternative investments. In particular, one-quarter plan to increase their current allocations to real assets/commodities (23%) and real estate/REITs (23%), with few planning to scale back their current level of investments over the next six months. Meanwhile, advisors are most likely to rely less on US and non-US fixed income, referencing increasing interest rates and inflation as reasons for moving client assets elsewhere.

Digging into advisors’ anticipated changes to asset class allocation uncovers a strong opportunity for active managers, international and emerging market fund providers, and leaders in alternatives. As advisors continue to navigate market uncertainty, they are more reliant than ever on the asset management firms they work with for timely thought leadership to help guide their investment decisions and support client conversations. Advisors’ increased reliance on digital communication, including webinars, website visits and emails, makes digital touchpoints crucial for boosting advisor consideration. A strong, multichannel thought leadership presence serves as an avenue for asset managers to promote their expertise, drive brand engagement and keep advisors feeling connected to their companies.

Each month we’re asking investors and advisors about the newest emerging trends in the wealth management space. Have something you want to ask these audiences? Send us a note!