In December 2019, Escalent acquired Javelin Strategy & Research, a research-based advisory firm with deep expertise in the digital financial ecosystem, to become an even more formidable player in the financial services space. Thanks to Jacob Jegher, president of Javelin Strategy & Research, for these insights!

Identity fraud, even without the underlying pressures of COVID-19, can undermine consumer trust in financial service providers. But, despite what you might hear in the news, identity fraud has not fractured consumer trust beyond repair. Consumers may have diminished trust in their financial institutions in certain aspects of their personal business relationships as identity fraud increases, but many are seeking guidance from their financial institutions on transacting through safer digital channels. At Javelin, we see this period as an opportunity for our clients to educate consumers to make better digital decisions.

Identity Fraud Increased with Fewer Victims

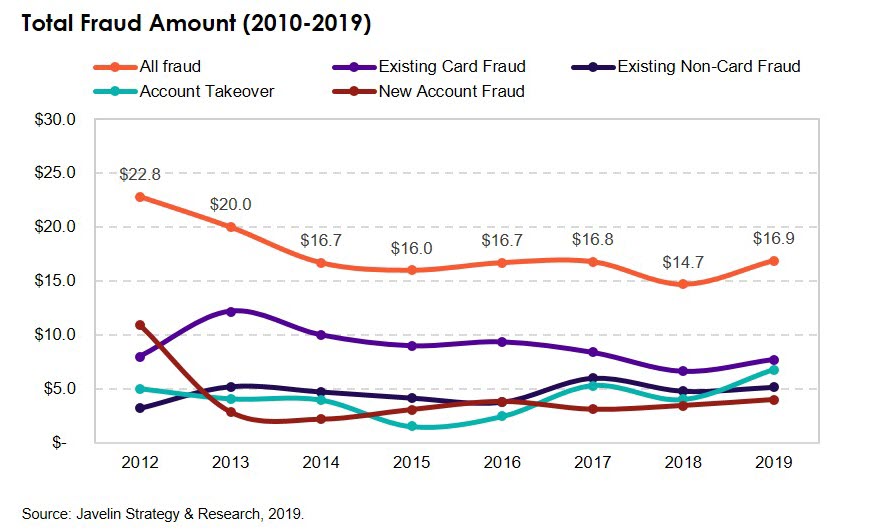

Total identity fraud reached $16.9B (USD) in 2019, but there were fewer victims. How did this happen? Criminals are targeting smaller numbers of victims with unprecedented precision and voracity. Taking over all of the financial accounts belonging to a single victim has become easier and more lucrative. In total, identity fraud increased 15% year-over-year.

Misconceptions on Identity Fraud

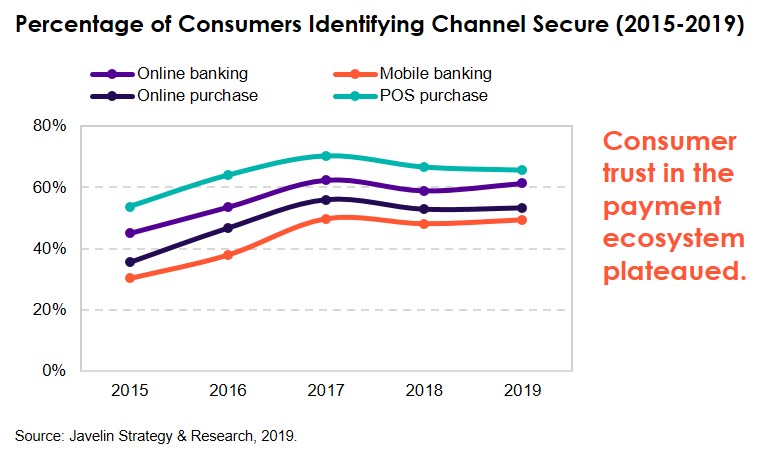

Our annual Identity Fraud Report shares powerful insight pertaining to consumers and their perception of trustworthy technology, including many misconceptions.

Consumers often classify anything with a static password as secure until proven otherwise. The fact that consumers regard mobile banking as less secure than point-of-sale transactions should be seen by everyone as a call to order to correct these misconceptions before they further erode consumer confidence and security. This insight alone, if corrected, would be an amazing benchmark in the battle against identity fraud.

There are a few things financial services providers can do to move forward and overcome the obstacles of consumer trust and misconceptions during these uncertain times. The spark that should fuel everyone’s mission should be focused on thoughtful changes that make clients’ lives easier to navigate. We consider trust to be a building block to future success; so, lean in, and don’t forget to ask us for help when you need it.

Javelin is also sharing data and insight in Escalent’s Financial Service COVID-19 Market Research Perspectives. Click below to read all thirteen volumes to date!