Understanding the Institutional Investor Journey When Selecting an Asset Manager

Institutional investors yield considerable decision-making power and often involve an extensive list of resources in their process of vetting and hiring a new asset manager. The firms vying for attention need to effectively differentiate yet not over-complicate their unique value propositions. Given the intensity of competition in the institutional market, asset managers need to make the most of every potential mandate to position themselves to win new assets. While many struggle with the challenges of building brand awareness to even get a chance to be considered, the most successful firms arm their sales, relationship management and product teams with insight on the decision-making process in order to maximize their opportunities of being selected.

Common triggers prompting asset manager searches include multiple periods of underperformance, investment team turnover, style drift, and corporate merger/acquisition activity. That said, new-manager hires are not always the result of the need to replace an incumbent, as institutional investors and consultants are open to opportunistic searches for new strategies that could enhance the overall portfolio. While performance and price along with familiarity and strength of the brand are integral in the evaluation of asset managers, a variety of more subjective factors weigh heavily in the final selection decision.

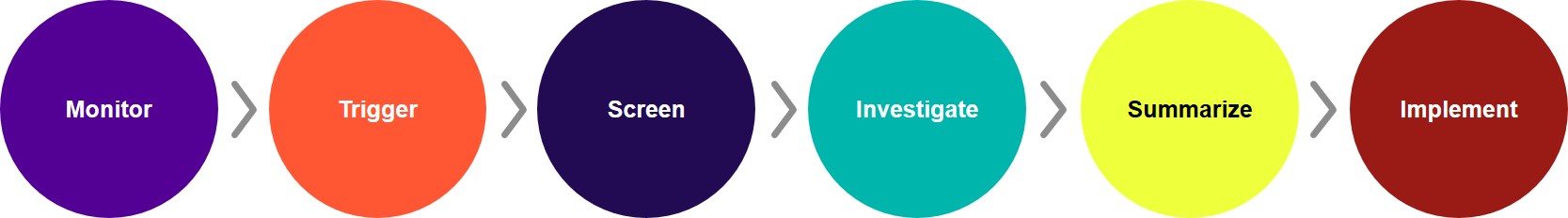

In the process of hiring an asset manager, all institutional investors follow a similar journey, with each type bringing its own nuances to the overall process. Along the journey, asset managers can leverage a number of points of influence to maximize their potential for selection. The people and additional sources of information also involved in the journey vary by type of institution, offering opportunities for asset managers to target their ongoing outreach to specific audiences. For example, consultant recommendations are by far the most influential factor for defined benefit (DB) pensions, yet peer recommendations, either formal or word-of-mouth, can be a gateway for endowments.

Institutional Investor Journey

In the future, the focus on fees is expected to continue while the attention to risk management and volatility will increase. In addition, the influence of data integration will play a more vital role in portfolio management. Within this context, asset managers can take a number of actions to stay top-of-mind and maximize their potential to win new business:

- Sharing knowledge through thought leadership, gaining knowledge by seeking to understand clients, and building personal relationships are key to a successful asset management business model.

- Asset managers can effectively differentiate by highlighting their unique capabilities, touting successful aspects of their businesses and exhibiting confidence through the strategies they manage.

Ongoing outreach in terms that clients can understand and a continual effort to demonstrate value along with attentiveness to inquiries are cornerstones of prosperous business relationships.

Send us a note to learn how Cogent Syndicated can help your firm uncover the key factors that influence asset manager hiring by institutional investors.