Build Resilient Brands with Data-Driven Insight

In just over two short years, the world has already weathered five to six different economic environments—an economic crash, stimulus, over stimulus, inflation, and potential stagflation or even recession as a result of tariffs toggling on and off. With so much fluctuation, businesses could be tempted to reduce risk by cutting expenses, including pulling back on market research, until things go back to normal.

But there’s no sign the dust is going to settle any time soon. By stopping market research in times of disruption, businesses will miss a major opportunity to gain market share by building loyalty with consumers at a time when they’re needed most. Why? Because in times of uncertainty, consumers flee to quality brands they trust and that understand what they’re going through.

Those in market research and insights roles play an important role in making sure their business is one of the quality brands that people seek out when looking for calm in the chaos. These researchers have the ability, and responsibility, to demonstrate what the consumer thinks and feels to the broader business so leaders can take appropriate action in the toughest of times.

When crisis hits, it presents a valuable opportunity to take action. And corporate researchers are poised to lead the way with data-driven insights.

Why should brands keep a pulse on consumer sentiment during times of crisis?

When the market is uncertain and volatile, businesses need more research—not less. Understanding consumer sentiment and tracking data can help predict how consumers will respond and shift their behaviors. These data provide businesses with valuable insight into what to do now and what to do when current conditions change again.

By doubling down on their brand and their understanding of consumers rather than waiting it out, these organizations have successfully navigated through times of crisis.

- During the financial crisis in 2008, JP Morgan Chase acquired Bear Stearns and Washington Mutual, positioning themselves as a stable, trusted company, restoring consumer confidence.

- Amazon used data to spot changing consumer habits during the dot-com burst, financial crisis, and the pandemic to expand offerings to meet consumer needs. They introduced Amazon Prime and Amazon Web Services, and adapted logistical infrastructure to meet pandemic demand.

- Through multiple crises, Apple kept their loyal customers by continuing to innovate with the iPod, iPhone, Apple Watch and other products, based on their deep understanding of evolving consumer needs and preferences.

Pausing market research, or misinterpreting it, increases risk

When brands stop doing market research, they miss important shifts in consumer sentiment and behavior, and risk losing customers who feel that the brand no longer understands them. By using research only as a descriptive tool rather than considering context, such as a crisis, brands can misinterpret data and lose the ability to forecast the future.

Here’s an example: One market research firm recalibrated its advertising performance benchmarks during the 2008 financial crisis after assuming an issue in measurement when what they thought were strong ads failed to perform. Instead of recognizing that consumer tastes had shifted, they tried to keep their benchmarks constant even though the world had changed. Companies that disregarded this flawed data performed significantly better, while those who followed it made poor advertising decisions. Continuous research provides a way to look at consumers in new and different ways throughout a crisis, helping firms uncover the new reality and how it’s impacting consumers perceptions. Without the context that market research provides, brands lose trust, relevance, market spend, and ultimately, customer loyalty.

Five strategic recommendations for brands to leverage market research and build resilience during disruption

Be the trusted advisor to guide business through uncertainty: Advisors give advice, they don’t just present data. Position market research findings by focusing on answering business questions rather than just providing insights. Proactively share recommendations with decision-makers rather than waiting for them to come to you. Demonstrate the strategic value of market research in driving customer loyalty and business success.

Integrate contextual data to anticipate broader market shifts: Understand the broader economic and market environment by incorporating contextual data into your research, including consumer sentiment, inflation, and—if your business is publicly traded—stock market performance and analyst opinions. Interpret research findings by considering all of these external factors. Key economic indicators, including consumer sentiment and retail sales, are available free through FRED from the St. Louis Fed.

Create communities to gather consumer insights: Build a place to interact and ideate with your consumers and your prospects online. Find real people who are the right people and hear from them directly on a regular basis. Their input can inspire more relevant solutions and give you a competitive advantage.

Make research tracking studies dynamic, adding or subtracting elements as needed: Continuously evaluate the relevance of tracked metrics, and quickly adapt studies to address upcoming issues and opportunities. If you have not done multiple experiments in any given year with your tracking study, you’re missing a massive opportunity to better understand consumer sentiment and your industry as it relates to your brand.

Use research to forecast the future, not just describe the present: Get the most from your research by using it to predict trends, advise leaders on the best action to take, and then adapt to meet customers where they are. Take a page from political polling: forecasting is hard but it’s important. Push your research to make sure it provides accurate and durable forecasts.

Times of crisis are times for action

Brands that demonstrate a deep understanding of their customers will be seen as trusted partners, increasing loyalty and their competitive edge. But this can only happen with contextual insights from market research.

Become the brand that consumers turn to through struggle and success by positioning market research as the strategic guide to getting through crises while building long-term loyalty.

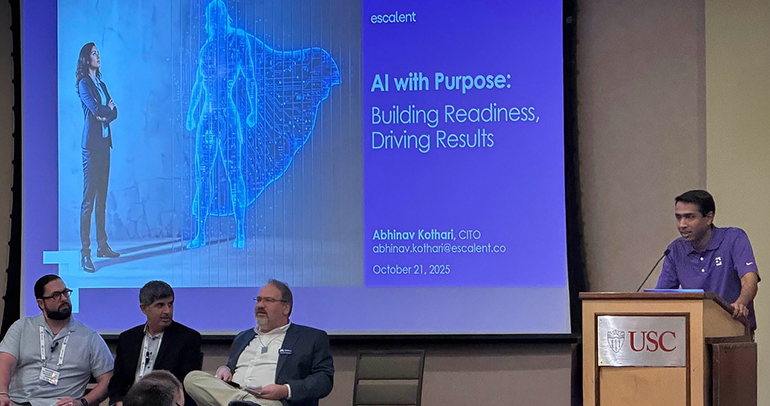

Find out more about how Escalent can help you stay connected with customers during a crisis. Drop us a note.

Want to learn more? Let’s connect.