As the COVID-19 pandemic continues, advisors are adapting to the increased volatility and unpredictability of the investment market in different ways. Many are utilizing model portfolios to scale their business, ensure more consistency and meet the needs of multiple types of clients simultaneously. At the same time, a majority of advisors report using custom models that they have created or modified themselves, highlighting the importance of offering portfolio construction tools and resources. In fact, according to Cogent Syndicated’s drivers of consideration for asset managers, offering tools, services and insights that help advisors with portfolio construction is among the leading criteria most likely to boost consideration.

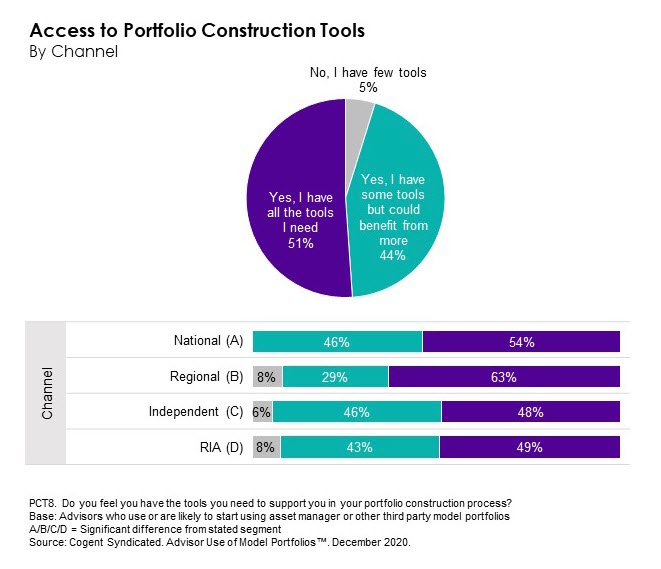

Pointing to a sizable opportunity, 44% of advisors using third-party model portfolios say they have some portfolio construction tools but could benefit from more. Interest in access to additional tools is relatively strong across the National, Independent and RIA channels. In contrast, nearly two-thirds (63%) of advisors in the Regional channel say they have all the tools they need. Revealing the influence of the home office in offering portfolio construction support, zero National wirehouse advisors report having access to few tools.

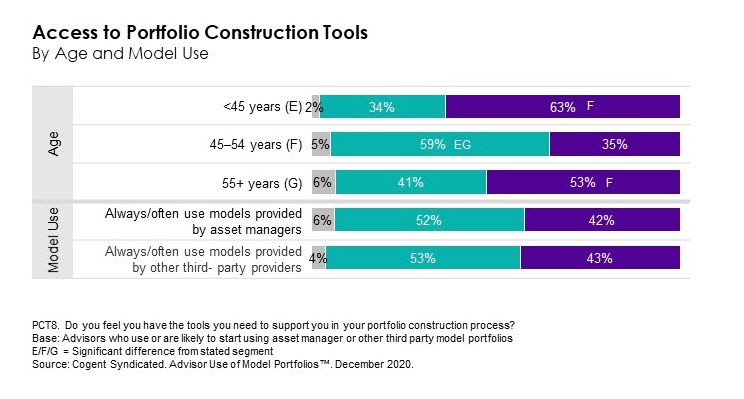

Interest in access to additional tools also varies by age and model use. Mid-career advisors ages 45 to 54 report the highest level of interest in additional tools (59%), while interest is weakest among advisors younger than 45 (34%) who expect to rely more on outsourced model portfolios and spend less time on portfolio construction. Notably, a majority of heavy users of models provided by third-party providers still see the benefit of having access to additional tools to support them in the portfolio construction process. This finding points to unmet needs related to managing hybrid approaches to portfolio construction.

When asked to expand upon areas of interest that third-party providers could share to better support advisors in portfolio construction, a variety of needs arose. In terms of specific tools, advisors mentioned needs related to back testing/hypothetical testing, the ability to export data or import data from external accounts, performance/return tools, portfolio comparison tools, risk analysis tools, fiduciary related tools and tools that allow for the inclusion of individual bonds and options. Among heavy users of third-party model portfolios, customization based on clients’ needs stood out as a top reason. Other areas of interest for portfolio construction support included research support, access to a breadth of products (including alternatives and niche products), ease of use/integration and objective fund recommendations.

Clearly, firms have an opportunity to highlight how they can serve as a resource in portfolio construction, in addition to seeking distribution opportunities via model portfolios. Providing access to quality tools, services and insights for portfolio construction will further support advisors taking a hybrid approach to portfolio construction and strengthen asset managers’ relationships with these advisors.

Advisor Use of Model Portfolios, our newest Cogent Syndicated report, explores shifts in advisors’ use of model portfolios, brand perceptions of leading model portfolio providers and unmet needs and expectations related to portfolio construction support. Click below or send us a note to learn more about the full report.