Key Takeaways

- Yes—“stylish” is the top attribute buyers want their next vehicle to convey, yet many current BEV designs fail to meet that expectation, according to Escalent’s EVForward® 2025 Product DeepDive study.

- Interior and exterior design are among the strongest drivers of BEV purchase consideration, with exterior styling shaping perceptions of the entire vehicle.

- OEMs that close the gap between desired and delivered design—while aligning style with segment-specific expectations—will be better positioned to earn a spot on buyers’ BEV short lists.

When consumers picture their next vehicle, one quality rises above the rest. Escalent’s EVForward® 2025 Product DeepDive study surveyed more than 1,500 new-vehicle buyers to understand how vehicle attributes influence purchase consideration of battery electric vehicles (BEVs). Using Escalent’s proprietary, data-driven Evoke™ approach, the study captures consumers’ subconscious emotional reactions to automotive design, revealing what shoppers feel when they see a vehicle.

The results highlight both a strong preference for and strong consideration driven by aesthetic appeal. In the study, we asked participants to select the top three descriptors they want their next vehicle purchase to reflect. “Stylish” emerges as the clear favorite, ranking 20 percentage points higher than second-place “functional” and 23 percentage points ahead of “practical” and “distinctive.”

Factors such as range and battery life tend to dominate the conversation around BEV adoption. However, our findings suggest that design may be missing from that dialog. In the survey, participants cite interior design (49%) as their top motivation for considering a vehicle. This is followed by exterior design (45%), which comes in ahead of body type/size (40%) and price (40%). Respondents rank price as the leading reason for rejecting a vehicle, but both interior and exterior design also surface as meaningful deterrents. Design can drive interest, but it can just as easily push buyers away.

BEV First Impressions Matter: How Exterior Design Influences Interior Perception

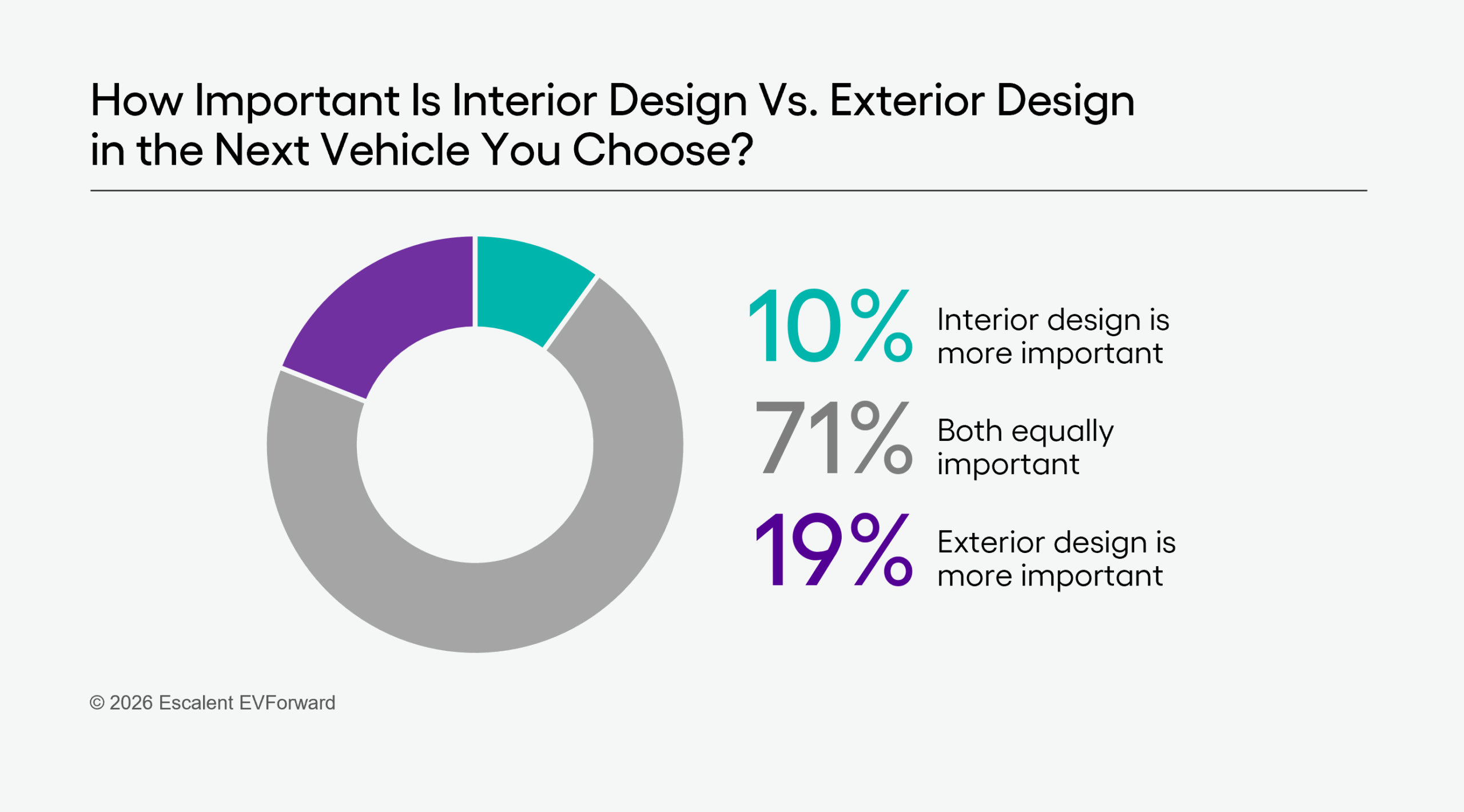

The majority (71%) of new-car buyers reveal that interior and exterior design are equally important to them when choosing a vehicle. That sentiment holds steady across EV Owners, EV Intenders, EV Open and EV Resistant consumers. It is also consistently expressed across all age groups and genders. The fact that interior and exterior design hold equal importance for consumers, however, does not mean the two elements are judged in isolation.

In the study, vehicle models that earn high scores from participants for exterior design appeal almost always receive stronger scores for interior design appeal. Since respondents evaluated interior design after exterior design, these findings suggest that the exterior anchors perception, meaning first impressions are likely to have an outsized impact on a buyer’s opinion of a vehicle’s overall design. When buyers are drawn in by what they see on the outside, they may be more forgiving of what they find inside. Likewise, if they don’t like a vehicle’s outward appearance, they’re less likely to respond to a thoughtfully designed interior.

BEV Owners Embrace Touchscreens—But Most Shoppers Still Want Buttons

As new buyers enter the BEV market, preferences around design and functionality are evolving. Nowhere is this clearer than in attitudes toward physical controls. Touchscreens are becoming the norm in new vehicles, yet respondents favor buttons for most functions. These include wiper and lighting controls, seat adjustments, window and mirror adjustments, trunk/hatch release, sunroof operation, HVAC and vehicle settings. Participants express a preference for using touchscreens to control only three feature categories: in-vehicle safety features, audio and navigation.

There is some variation in patterns of touchscreen acceptance between different buyer segments. Notably, EV Owners demonstrate greater comfort with digital interfaces, favoring touchscreens for half of the features listed. On the other end of the spectrum, EV Resistant shoppers opt for touchscreens only in two cases (audio and navigation). Broadly, these findings signal that, while consumers have embraced touchscreens in some instances, a fully screen-dependent approach is misaligned with consumer preferences, particularly for those who are yet to go electric.

The Case for Prioritizing BEV Curb Appeal

Design is not the only factor that drives vehicle consideration. Priorities such as price, range, battery warranty and charging performance remain top of mind for consumers. That said, our research suggests the BEV market is falling short when it comes to curb appeal. While respondents overwhelmingly identify “stylish” as the attribute they want most in their next vehicle, when evaluating the exterior appeal of existing BEV models, “stylish” falls to the middle of the pack. Buyers may want a stylish vehicle, but many do not appear to see that quality reflected in the options available to them today.

This presents an opportunity for original equipment manufacturers (OEMs) developing new BEVs to place greater emphasis on design, particularly in ways that resonate with shoppers predisposed to their specific vehicle segment. Style is not interpreted uniformly across the market. For example, we found that, among pickup purchase intenders, the descriptions most strongly linked to exterior appeal are “exciting,” “spacious” and “adventurous.” SUV purchase intenders respond most to “luxurious,” “exciting” and “stylish,” while sedan purchase intenders prioritize “responsive,” “luxurious” and “exciting.”

Vehicle Design Isn’t Everything But It’s Becoming a Leading BEV Purchase Driver

Differentiation in the BEV space is less about pursuing novelty and more about delivering a vehicle design that aligns with how buyers define exterior and interior appeal within their desired vehicle segment, especially as the market moves from early BEV adopters to more mainstream consumers. Design alone won’t sell a BEV, but it might just determine which models make the short list.

The BEV audience is changing. Are your vehicle design strategies keeping pace? Reach out to one of our BEV experts today to find out using the form below.

Want to learn more? Let’s connect.

About the EVForward® 2025 Product DeepDive

This EVForward DeepDive was conducted among a national sample of 1,515 respondents—with 148 EV Owner, 380 EV Intender, 471 EV Open and 516 EV Resistant respondents as identified by Escalent’s algorithm—from September 8 to September 24, 2025. These respondents are a subset of the EVForward database, a global sample of more than 50,000 new-vehicle buyers age 18 to 80, weighted by age, gender, race and location to match the demographics of the new-vehicle buyer population and by vehicle segment to match current vehicle sales. The sample for this research comes from an opt-in online panel. As such, any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.