The age of the uncritical investor is over. In 2025, affluent investors are rewriting how they invest—and whom they trust with their investment portfolios. Artificial intelligence (AI) is surging not as a replacement for human advisors but as an essential tool that empowers investors to “trust but verify,” blending digital decision-making with a human safety net like never before.

Are Affluent Investors Using AI to Make Investment Decisions?

This year’s Escalent Cogent Syndicated Investor Brand Builder™ report based on a survey of 5,038 affluent investors reveals that adoption of AI-powered investing tools has soared to 37%, up sharply from 30% last year. Use is highest among young, digitally savvy generations, with 78% of Gen Z and 75% of Millennials now using AI for investment decisions, compared with 40% of Gen X, 23% of 2nd Wave Boomers, and just 7% of 1st Wave Boomers and 6% of the Silent Generation. Notably, AI adoption isn’t limited to self-directed investors—use among those who are advised by an investment representative has jumped from 28% last year to 38%, while self-directed adoption has risen from 27% to 35%. This broad embrace of AI marks both generational shifts and a revolution in how affluent investors make decisions.

Are Affluent Investors Trusting AI Over Advisors?

The short answer? No. Human advice remains central, but “trust but verify” now prevails.

Human financial advisors remain highly relevant. Trust in the investment community is at a record high, with 70% of traditionally advised investors expressing trust in 2025, up from 64% in 2023. Yet, even as trust grows, more investors are double-checking advisor recommendations before acting or doing their own research, often turning to AI and digital tools. At the same time, advised investors are also increasingly likely to accept advisor recommendations. This hybrid approach delivers both reassurance and better outcomes.

Frequent, Satisfying and Impactful: The New AI-Enabled Investment Experience

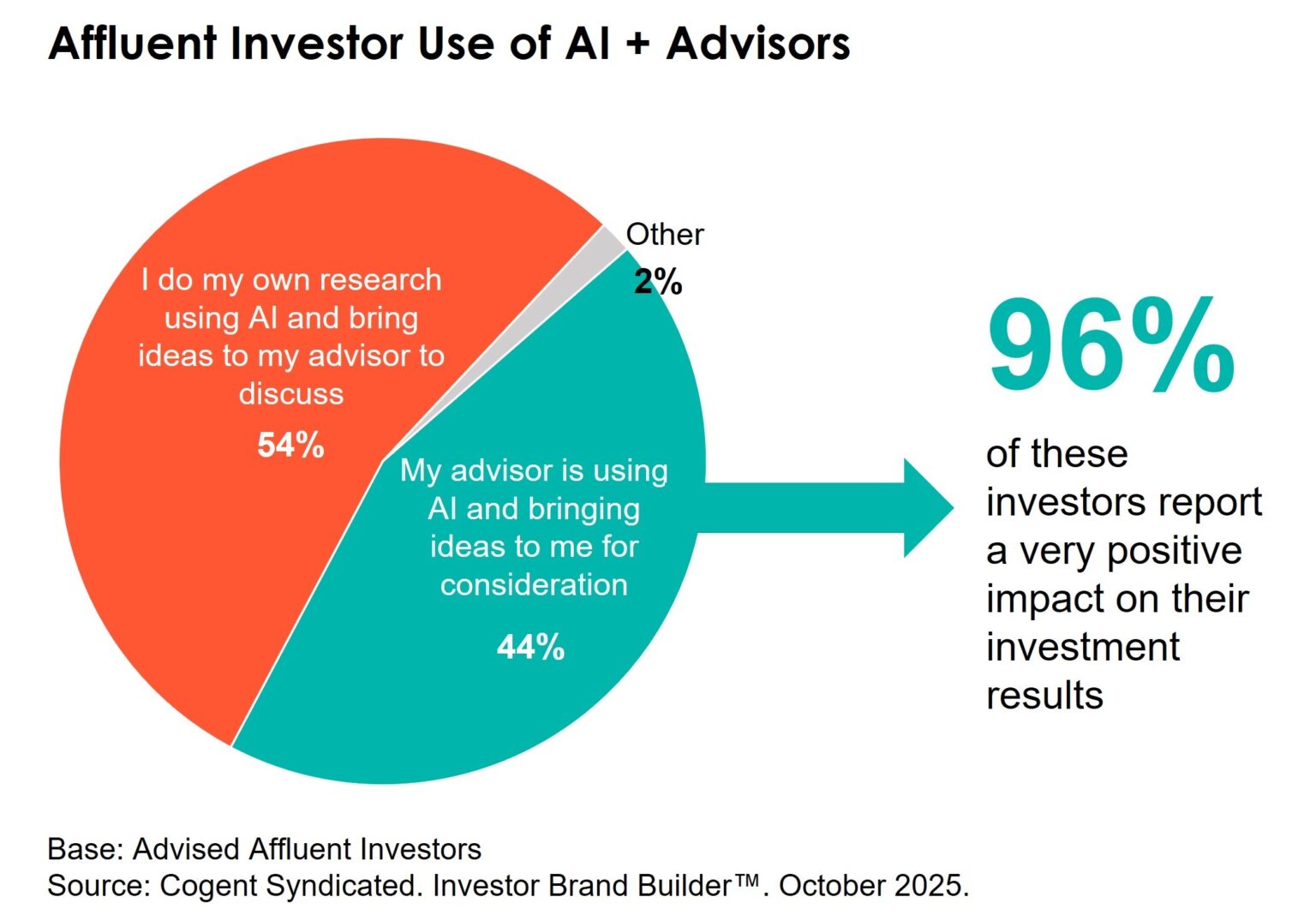

The impact of AI is not theoretical: 44% of affluent investors’ advisors are already bringing AI-driven ideas to them for consideration; of those, 96% say it has positively affected their investment results. Moreover, the frequency with which investors engage AI for investment activities is rising fast. More than half (53%) of those using AI for investment decisions do so daily (24%) or multiple times per day (28%), underscoring a deep operational integration that goes far beyond surface-level adoption.

Key Takeaway: AI Represents Both an Opportunity and Challenge for Every Wealth Provider

AI is not eroding trust in financial advisors, it is redefining and raising the bar for what it means to deliver credible, personalized and validated advice. Investors want the best of both worlds: digital empowerment and human wisdom. Firms embracing this hybrid “trust but verify” landscape are poised to win both next-gen and legacy clients. Those that resist risk getting left behind, as tomorrow’s investors demand transparency, performance and partnership—powered by both people and machines.

Our full Investor Brand Builder™ study provides a clear, comprehensive view of the trends shaping the affluent investor market to help firms uncover new opportunities for growth and enhance profitability. For more information about the report, click below.