Over the course of this year’s turbulent investment environment, affluent investors have grown less and less confident with the stability of the US economy, and it’s having an immediate impact on their purchase behavior. In the recently released Annuity Brandscape report from Cogent Syndicated, we observed an increased interest in annuity investments, primarily driven by younger affluent investors. Affluent Millennial and Gen X investors now make up more than half of the total annuity user population. Yet despite a renewed interest in annuity products, financial advisors plan to sell fewer annuity products over the next two years.

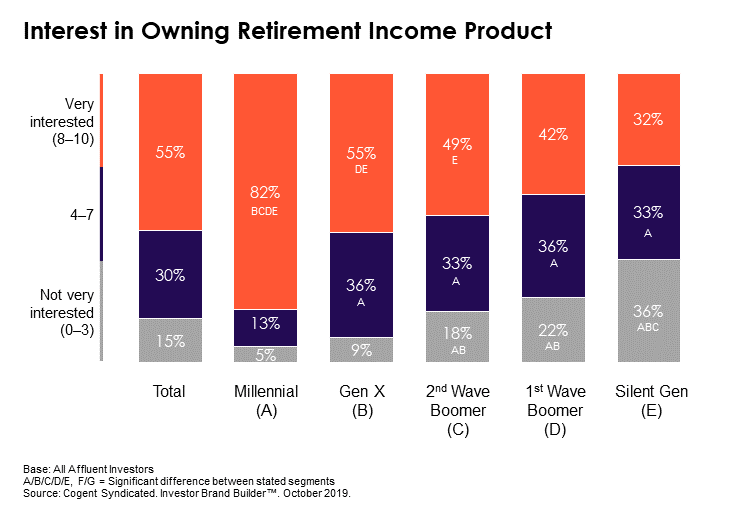

Financial priorities and methods of generating in-retirement income differ substantially by generation. Contrary to conventional wisdom that annuity products are solely for older generations, Millennials make up half of the “ready-to-act” investor population reporting an interest in adding annuities to their existing investment line-up. Younger affluent investors, are looking for alternative retirement income solutions given the uncertainties surrounding the longevity of Social Security, and they are significantly more interested in investment products designed specifically for generating retirement income than their older peers. Millennials, who are least concerned about outliving retirement savings, place a stronger emphasis on ESRP and annuities to generate income in retirement. And, relative to their older peers, Millennials are significantly more open to a discussion about retirement income with an advisor or the option to purchase an annuity product within an ESRP, suggesting that the presence of annuities in investors’ portfolios offers comfort and confidence in their long-term financial stability.

However, despite the growing interest in annuities, financial advisors are planning to sell fewer annuities over the next two years. In fact, few retirement plan advisors recommend the use of annuities in their client’s retirement plan, with just 8% of plans serviced by DC advisors offering in-plan annuity options to participants*. Instead, financial advisors are focusing more on ETFs and separately managed accounts to grow their advisory business and move further toward fee-based compensation structure. This move to sell fewer commission-based products is a choice that directly affects both their product and provider preferences. As some advisors plan to increase their allocations to ETFs and mutual funds, two vehicles they consider suitable for the purpose of retirement income, those who continue to sell annuities emphasize the importance of guaranteed income in retirement as the leading reason to include these products in client’s portfolios.

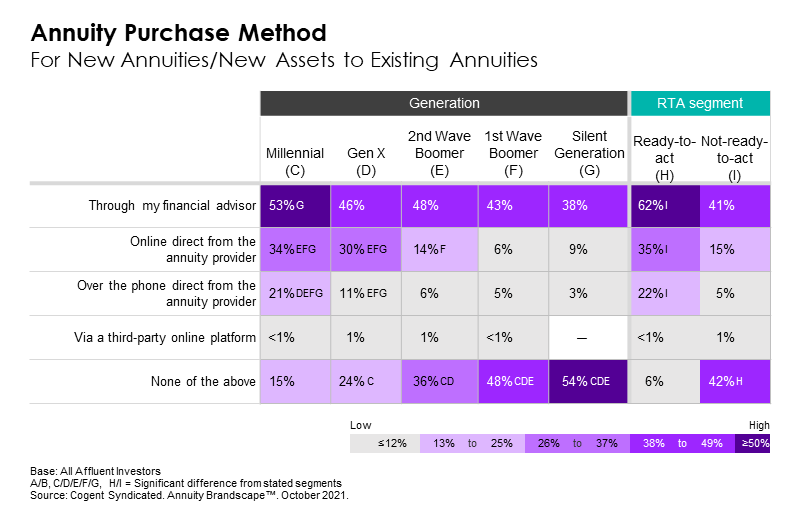

Instead of following their advisor’s led, ready-to-act investors are considering avenues outside of their traditional advisor to access annuity products. Influenced by the younger affluent population, one-third of ready-to-act investors would consider circumventing the use of an advisor by purchasing an annuity online directly from an annuity provider.

Opportunity Ahead for Annuity Providers

Ready-to-act investors are clearly taking a more hands on approach in their retirement planning. Over the past two years, investors working with an advisor engaged more with their investment professionals, making suggestions and independently researching and reviewing investment opportunities. Given that younger investors are not likely to benefit from government sponsored Social Security payments, they are open and looking for other guaranteed ways to generate income in retirement. Annuity providers have an opportunity to educate advisors on the unique needs of the emerging population of investors who now want to add an annuity product to their line-up, and share materials advisors can use to aid the advisor and investor relationship. And, as investors are doing their own research, savvy annuity providers can also get a jump on the competition by shoring up their consumer-facing website capabilities to appeal to these potential buyers to address the leading financial priorities of younger affluent investors poised to purchase annuity products.

Click below to learn more about what’s included in the full Annuity Brandscape report.

* Source: Cogent Syndicated. Retirement Plan Advisor Trends™. September 2021.