Now more than ever, key influencers in the DC marketplace are becoming increasingly focused on the best interest of plan participants. Providers are vying to come up with the industry’s newest innovations to provide best-in-class participant service and support offerings. As DC plan sponsors and DC advisors renew their commitment to plan participants, one generation is slated to take the current DC service model to new heights: Millennials.

Findings from our newly released DC Participant Planscape™ study reveal that Millennial plan participants age 37 or younger are not only the biggest advocates of financial wellness programs and provider outreach and educational offerings, they are also the most likely cohort to change their investment offerings and initiate a rollover IRA.

Overall, only 12% of all plan participants expect to increase their DC plan contributions and just 16% are ready to make investment plan changes in the next three months. But the majority of participants who intend to change their investments are Millennials (62%), making them ideal targets for guidance. In addition, nearly eight in ten Millennials expect to roll funds in the next 12 months (79%), making them the easiest rollover IRA candidates.

New business potential aside, perhaps what’s even more striking is that Millennials are touting a more personalized service model even as they harness and take advantage of the latest digital innovations being offered to them. This year, the most loyal Millennial participants cite responsiveness of phone service reps as the hardest area for a new DC provider to be able to replicate, underscoring the importance of human connection.

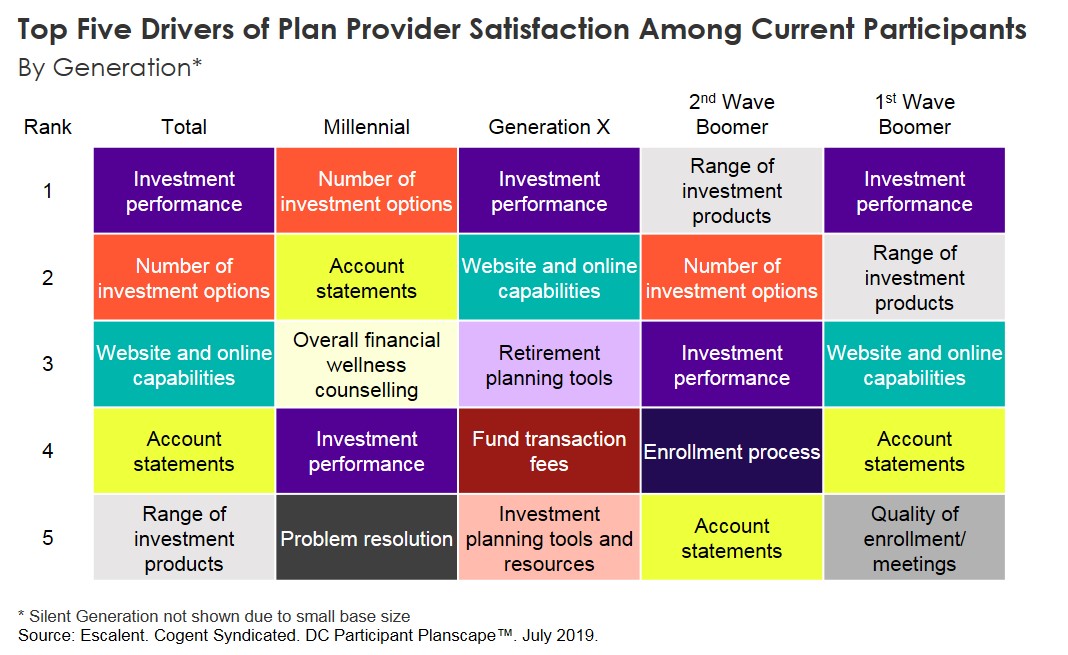

Another sign of disruption is upon us: in sharp contrast to their peers, Millennial participants are less influenced by investment performance when it comes to driving plan provider satisfaction. In 2019, number of investment options, account statements and financial wellness counseling are more influential satisfaction drivers among participants age 37 and younger. 2nd Wave Boomers are also more focused on range and number of investment options.

In order to maximize new business potential, DC plan providers and investment account firms must stay two steps ahead of Millennials’ evolving service needs and expectations, and be willing to adapt to a more all-encompassing service model.

Click below for more on the DC Participant Planscape report!