The high impact but oft-forgotten area of brand research

Nearly 20 years ago, I worked with a global CPG corporation that owns some of the world’s most well-known liquor brands. In addition to maintaining one of the largest advertising budgets on the planet at the time, the organization also plowed tens of millions of dollars into high-profile sports sponsorships. Yet unlike the advertising spend, which was subjected to intense scrutiny to measure impact and return on investment, the sponsorships ran year after year with little or no measurement of their value or effectiveness.

When I, as a curious little whippersnapper, dared to ask why we only measured one side of the marketing mix, I received only terse replies that included “The brand is tied to the event, so why waste money measuring it when we know we have to do it anyway,” “Don’t be silly, there’s no proper way to measure sponsorships,” and “As long as the chairman can still walk 18 holes at St Andrews, we’ll be sponsoring golf tournaments, regardless.” I recall feeling quite disturbed at what I perceived to be not only a marketing blind spot but a gross oversight in corporate governance. Two decades on, I’m still amazed at how often the area of sponsorships is overlooked when organizations measure the effectiveness of their marketing efforts.

An Elephant Hiding in Plain Sight

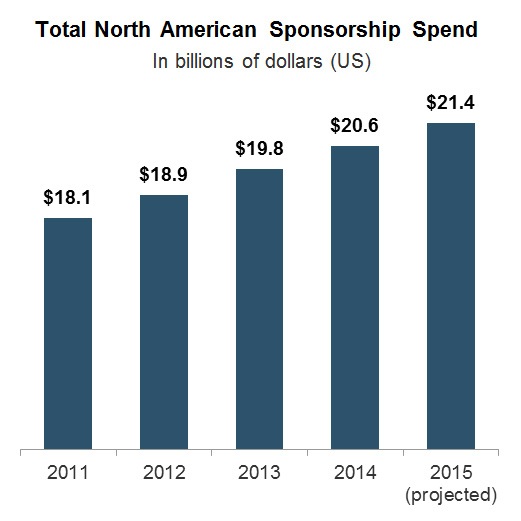

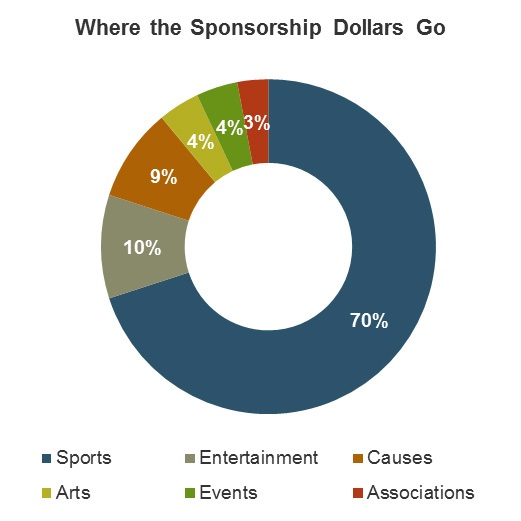

Sponsorship spend in North America will exceed $21 billion in 2015, which is equal to one-third of total television advertising, or one-half of all digital advertising. Nearly three-quarters of this is spent on sports, which won’t surprise anyone that has turned on a TV or been to a stadium in recent years. Sponsorship spend is also increasing at a faster rate than anything else in the marketing mix, having grown by 4.2% in 2014, compared to 3.1% for advertising and just 2.8% for public relations/promotions/direct marketing.

Sponsorship fees themselves are typically only half of the equation, as they are often more than matched by subsequent spending to advertise and promote them, so it’s fair to say that this area of marketing will approach $50 billion in spend before the year is out. You’d think that such a substantial marketing investment would be supported by a powerhouse of research in order to determine its effectiveness. But you’d be wrong. A recent analysis by the Association of National Advertisers uncovered some alarming statistics:

- Only 35% of marketers consistently measure the impact and effectiveness of their sponsorship activities.

- A full 25% of marketers do not gather, analyze or use any data at all in their sponsorship decision-making, choosing to work on gut instinct alone.

- Of those that do conduct some form of measurement, only 47% have implemented a standardized process for sponsorship measurement.

- When carrying out sponsorship measurement, only half of marketers make any attempt to isolate the impact of sponsorships from their other marketing initiatives.

- Yet nearly 80% report that the need to validate sponsorship results has increased significantly in the past two years.

If those numbers aren’t bad enough, in many cases where sponsorship research is actually conducted, the analysis is carried out by either the ad agency or the sponsorship management company. And once the foxes are looking after the henhouse, it’s not surprising that in many cases this research is biased, weak on meaningful measures and consequently not particularly valuable to decision-makers.

Non-Measurement for All the Wrong Reasons

The reasons for this apparent blind spot are numerous. Very often, organizations invest so much budget and energy into a sponsorship that they simply don’t leave anything more to measure the impact. In other cases, nobody bothers to measure sponsorship effectiveness because the sponsorship “just feels right.” After all, who is going to argue that having the corporate logo plastered across a major sporting arena is anything but a marketing coup?

Other times, the sponsorship is a pet project of an executive, or the organization has been doing it for many years, so conducting an assessment of the sponsorship value potentially carries some political risk.

Top Tip: Measure Outcomes, Not Outputs

Many marketers make the mistake of collecting data that are easy to measure, rather than what actually matters. As a result, they end up measuring ‘outputs’ such as what a sponsor got or did, rather than ‘outcomes’—what a sponsorship actually produced with the target audience. The most common outputs measured are media exposure and digital impressions. But these proxy measures aren’t able to capture whether a sponsorship actually impacted perceptions, attitudes and behaviors, leading to purchase and other desired actions.

Perhaps most alarmingly, the most oft-cited reason for not measuring the effectiveness of sponsorships is that marketers don’t see the value, or worse still, just don’t know how to do it. One of my client-partners recently captured her sponsorship challenges rather succinctly when she said:

“Most of us don’t even know where to start. Tallying of press coverage or social media buzz is just so cumbersome and doesn’t really give me anything meaningful. But if I do primary research with our target market, how do I tie that back into our brand research, or reliably link it to the measures that matter to my executives, like sales and profits?”

With this frustration in mind, let’s take a look at the “why” and “how” of good sponsorship measurement.

Why You Need to Measure

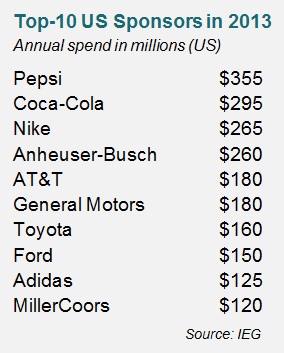

More than 100 US companies have sponsorship budgets in excess of $15 million, and the largest sponsors such as Pepsi, Coca-Cola, Nike and Anheuser-Busch spend well in excess of $200 million per annum. Given the size of these investments, the rationale for measurement should be obvious, and includes the following:

More than 100 US companies have sponsorship budgets in excess of $15 million, and the largest sponsors such as Pepsi, Coca-Cola, Nike and Anheuser-Busch spend well in excess of $200 million per annum. Given the size of these investments, the rationale for measurement should be obvious, and includes the following:

- Corporate Governance: Like any other company expenditure, the sponsorship spend needs to be clearly justified. So doing the research that identifies the causal links between the investment and corporate KPIs and/or financial returns is a critical corporate governance function that marketing is obliged to undertake.

- Protect your Budget: If you want to protect your sponsorship budget for next year, set about proving the value that it’s providing this year. Maintaining a consistent budget is particularly important for sponsorships associated with popular properties (e.g. NFL or MLB) where there are considerably more sponsors, many of whom might have been around for decades. In these instances, it may take years of investment to “break in” and gain consistent awareness and behavioral change with fans.

- Prioritize Opportunities: Most companies spread their budgets between a number of sponsorship properties in order to maximize reach or target disparate audiences. Effective measurement allows you to assess the relative merit of each sponsorship as it relates to corporate goals, allowing you to make informed decisions about which sponsorships to maintain and where to prioritize budget.

- Renegotiation Power: Perhaps the greatest value you’ll see from effective sponsorship measurement is when it comes to renegotiating your sponsorship contract. Having detailed data regarding what works best for your company provides you with far greater power, allowing you to focus on the opportunities that matter and negotiate a cost that you can confidently predict will deliver an ROI. I’ve recently witnessed a client-partner optimize the modules of their sponsorship with a major US sports league while saving nearly $10 million, all through having the right insights.

How You Should Measure Sponsorships

The ‘how’ is where most marketers get stuck, but, in fact, it’s relatively easy to get started with some fundamentals. The first step is to determine who is going to do the measurement, and if you’re looking for the data to deliver actionable insights and have credibility with your leadership, my strong recommendation is that you hire a team of independent professionals. Don’t let foxes into your henhouse.

The second step is to clearly define your audience on the front end. The audience definition should be relatively obvious—after all, you got into this sponsorship in the first place to reach a specific target segment. Perhaps you’re a tech brand looking to reach a senior business audience at a golf tournament, or maybe you’re an energy drinks brand that is looking to connect with Millennials by sponsoring a series of music concerts. Whatever the segment(s), have the demographic profile clearly defined up-front so you can zero in on the impact with the people that matter most to your brand.

But don’t stop there. An even more crucial (but often overlooked) part of audience definition is fan classification, and specifically defining the ‘avidity’ of fans. Typically, you’ll want to define three fan classes:

- Avid fans who are deeply involved in the sponsorship property through regular attendance or viewership of events, as well as other engagement (e.g. online, social media)

- Casual fans who have more of a passing interest

- Non-fans who have no interest at all

Using fan classes to break out different audience segments in your research will allow you to benchmark your impact based upon the level of engagement with the sponsorship property, see how closely your target market matches the fan base and, ultimately, measure the lift that is achieved over the general population.

Top Tip: Define Your Avid Fan Up-Front

How do you determine if a person is an ‘avid’ fan? The truth is, it can vary greatly from one sponsorship property to another. I strongly recommend running a short pre-survey for fan classification purposes, getting measures for awareness, interest, attendance/viewership, and different types of engagement. Subsequent analysis of the combinations of these measures should provide clear fan segments that can then be utilized in the core research.

Then it’s down to business—conducting primary research within the broader market to measure the impact of the sponsorship. To do this, your research will need to pay attention to both sponsorship health and brand health.

Sponsorship Health measures how well the sponsorship itself is performing and needs to focus on the following key areas:

- Awareness: You’re more than likely doing awareness testing as part of your brand tracking and advertising testing, and it’s important to apply the same principles here. At an unaided and aided level, are respondents able to recall your overall sponsorship of a property, or specific facets of it (e.g., a halftime advertisement)?

- Perceptions: Of those that are aware of the sponsorship, how do they perceive it? Do they find it appealing? Do they think it’s a good fit? Does it cause them to want to take action?

- Engagement: Going deeper than pure awareness, look to implement measures that align with what the sponsorship advertising is trying to achieve. Think of specific actions that are taken by the consumer as a result of exposure to the sponsorship, such as researching online, visiting a store or making a purchase. This is more nuanced than awareness metrics, but crucial to proving an ROI that aligns with the original objectives, so focus on getting a tight measure on actual behavioral change as a direct result of the sponsorship.

Test Your Own Awareness

Marketers regularly overestimate the impact of their sponsorship and, upon conducting research, are often stunned when they stumble at the very first hurdle–awareness. It’s not uncommon to find that less than 20% of avid fans are able to recall even the largest sponsors.

Does that sound really low? Why not test your own awareness. Grab a pen and paper, write down the major US sports leagues (NFL, MLB, NBA, NHL, MLS and NCAA), and now try to recall the largest sponsors next to each. Done? Check the table at the end of this article—you’ll be amazed how many well-known brands you completely forgot.

Brand Health measures the specific impact of the sponsorship on brand equities and the consumer journey (or purchase funnel). Sound familiar? Of course it does—you’re likely doing a lot of brand research already, so here’s your opportunity to tie the two together and enhance the value of each. The key is to leverage the brand research you conduct with the general market, and ask exactly the same questions of those that have been exposed to the sponsorship. Stand the two pieces of research side-by-side, and you’ll be able to determine the incremental lift that the sponsorship is delivering to brand equities as well as purchase funnel metrics such as awareness, knowledge, consideration, preference and purchase. Remember, if you’ve done a good job of audience definition, you’ll be able to not only get the headline measures, but also build detailed cross-tabs to compare the lift in specific demographics and fan classes. So, for example, you should note greater lift among avid fans, but is this lift consistent across all income groups?

The final step is the one that will matter most to your leadership: taking these incremental lift percentages and applying them back to actual population volumes. This will provide you with actual raw numbers of people that have been directly impacted by the sponsorship. If you’ve nailed down your engagement metrics well, you will be able to measure the volumes of consumers that, for example, now have a stronger preference for your brand over competitors, or an increased intent to purchase. Apply those volumes to the actual cost of your product—whether it’s soda, cellphones or SUVs—and you will be able to not only calculate incremental revenue attributable to the business as a result of the sponsorship investment, but also determine the overall ROI for the sponsorship as a whole.

Next Stop: Rolling Up Your Sleeves

Of course there is much more that can be done to dig into the finer details of sponsorship effectiveness. Once you have the framework outlined above in place, you can begin to overlay additional measures and sources of data—for example, digital media metrics associated with ad clicks or social media buzz, or actual behavioral data collected from sponsorship engagement activities (texts responding to a halftime ad on the Jumbotron, or your call-to-action hashtags embedded in tweets).

It’s all possible once the need for sponsorship measurement is acknowledged and the fundamentals have been put in place. Before you know it, your organization will be making sponsorship decisions based on detailed and reliable insights, and not on whether your chairman still gets out on the golf course.

How are your sponsorships performing? If you’ve got some thoughts to share on the topic or would like to discuss sponsorship measurement in more detail, I invite you to contact me or comment on this post.

Here are the major sponsors for the largest sporting leagues in the US. How did you do with your own sponsorship awareness?

Click below to download your copy of The Emotional Value of Sponsorships.