Institutional investors have long incorporated alternative investments in their portfolios to diversify their holdings and enhance their investment returns. Yet over the past year, these investors—particularly those managing defined benefit (DB) pension funds—are seeking to capture tactical opportunities and increasingly turning to alternative investments as a means to do so.

Use of Alternatives

According to Investopedia, an alternative investment is a financial asset that does not fall into one of the conventional investment categories of stocks, bonds and cash. As that leaves the field wide open, we asked institutional investors about their use of and intent to increase or decrease holdings in several specific categories:

- Private equity

- Real assets/commodities

- Real estate (including REITs)

- Digital assets/crypto-currencies

- Other alternatives

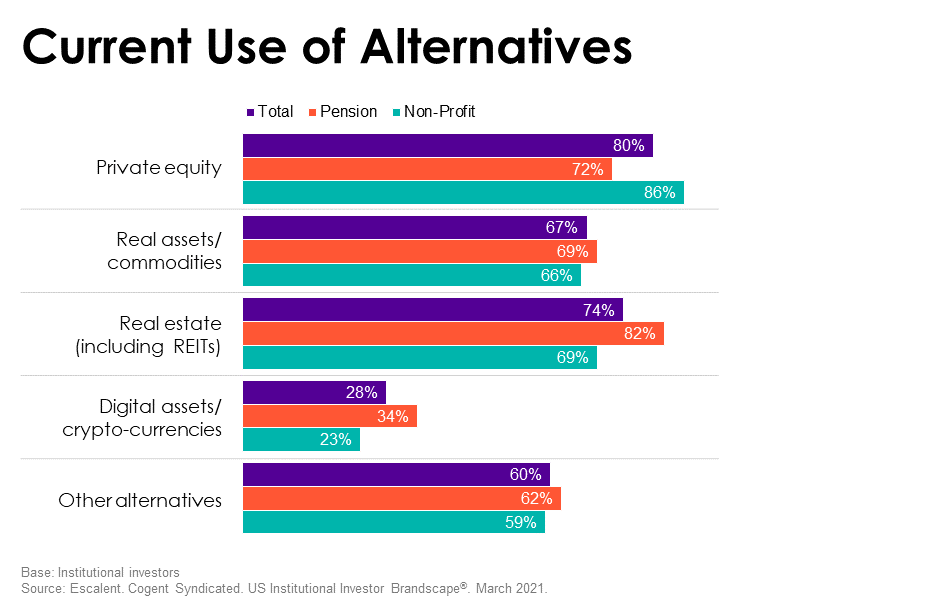

Private equity is the most ubiquitous in the institutional market, as 80% of institutions invest in the category (72% of pensions and 86% of non-profits). Real estate is a close second, with 74% of institutions (82% of pensions and 69% of non-profits) invested in the category. Two-thirds (67%) of institutional investors incorporate real assets/commodities in their portfolios, and six in ten (60%) invest in other alternatives.

Interestingly, 34% of pension funds and 23% of non-profits invest in digital assets/cryptocurrencies. In fact, 38% of corporate DB plans and 35% of endowments already incorporate digital assets/cryptocurrencies into their portfolios.

The Future of Alternatives

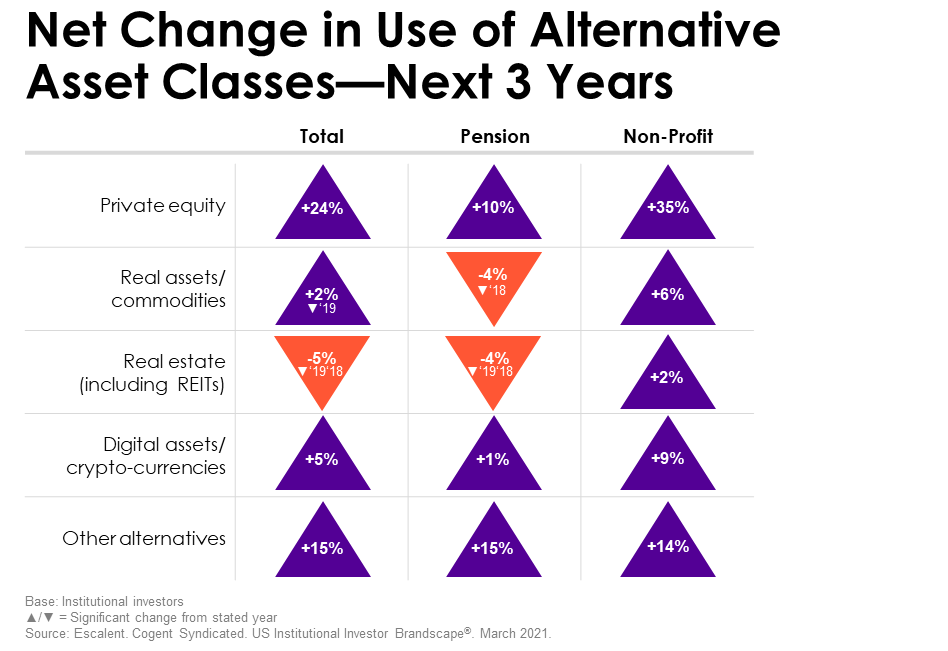

To provide insight into the areas of most demand for future mandates, we asked institutional investors to forecast if and how their use of alternative asset classes will change over the next three years. Private equity is poised for the most growth, as a net 24% of institutional investors project an increase in their use of the category (36% forecast an increase while 12% anticipate a decrease). Yet it’s important to note that non-profits are clearly driving demand in this category, as 35% of them report an anticipated net increase in private equity use over the next three years compared with 10% of DB pensions.

The “other alternatives” category is also an area of interest, with a net 15% of institutional investors anticipating an increase in allocation to the category. Moreover, this demand is nearly equal between pensions (15%) and non-profits (14%).

The same cannot be said, however, for real estate and real assets/commodities. Institutional investors project a significant decrease in their use of these asset classes compared with previous years. Meanwhile, investors project a slight increase in their use of digital assets/crypto-currencies, suggesting that this category needs a little more time to prove its value.

More About “Other Alternatives”

For deeper insight into the “other alternatives” category, we asked institutional investors planning to increase allocations to alternatives to specify which strategies they are focusing on. Multi-asset strategies, which offer the opportunity to increase diversification and reduce risk, is the most-cited alternative strategy for both pensions and non-profits, in-line with the demand we’ve heard from financial advisors. Pensions report a higher interest in risk-managed equities and managed futures compared with non-profits. Meanwhile, long-short equities and managed neutral strategies are more intriguing to non-profits than to pensions.

The Bottom Line

To optimize their messaging, asset managers offering alternative investments need to demonstrate an understanding of the outcomes institutional investors are hoping to achieve with these strategies. In addition, it’s critical for asset managers to position their offerings to the appropriate and most receptive audiences.

Firms specializing in real estate, real assets or commodities don’t need to completely throw in the towel. Instead, they should weather the temporary drop in demand by strengthening their conviction and providing real-life examples of how these strategies can and will add value to institutional portfolios.

Finally, all institutional asset managers would be wise to keep an eye on the growing popularity of cryptocurrencies, as the category could be the next industry disruptor.

This is just a tiny snaphshot of the insights from the US Institutional Investor Brandscape report. Click below to learn more and send us a note to learn about how the report can help your firm.