As the vast majority of advisors are using model portfolios to a certain extent, there is an opportunity for asset managers to build and strengthen advisor relationships by expanding distribution through models. However, not all advisors express the same needs. Some outsource portfolio construction to third-party providers while others simply use model portfolios as a resource in building their own investment strategies. Not to mention differences in use of model portfolios by channel. Thus, as advisors continue to rely on model portfolio resources in the coming year, asset managers have a chance to step in and provide different types of portfolio construction support.

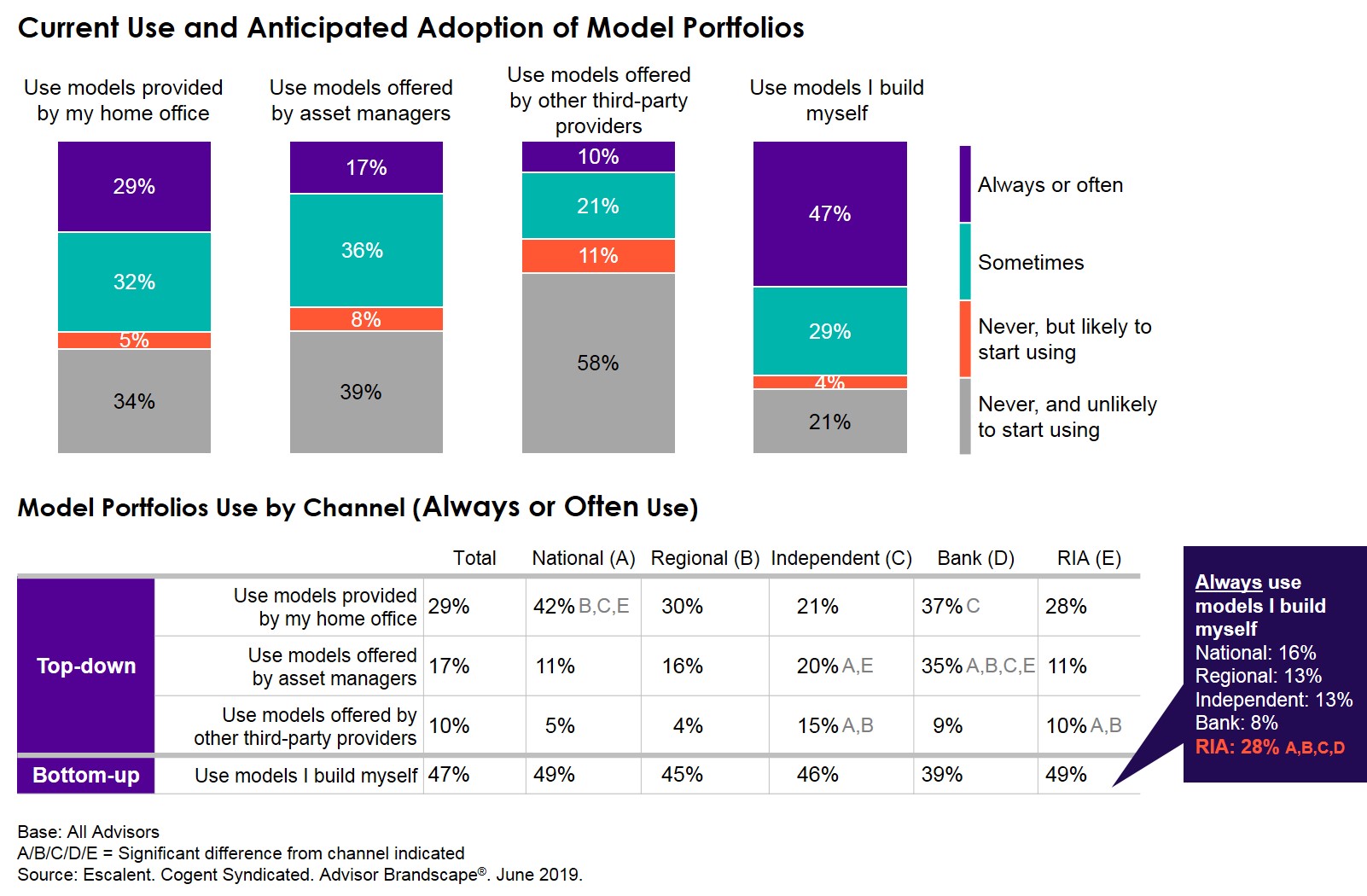

Overall, advisors report being most reliant on models they build themselves, with nearly half (47%) saying they use self-built models often or always. Approximately three in ten (31%) advisors are currently using models from third-party providers, with Independent planners being most likely to say they rely on these models always or often. Use of third-party models is expected to grow, with 11% of advisors likely to start using them for the first time.

More than half (53%) of advisors use asset manager models; however, reliance is much weaker among RIAs with only 11% using these models often or always. In contrast, more than one-quarter of RIAs (28%) say they always use self-built models, nearly double the proportion of their peers in other channels.

Considering that model use varies by channel, asset managers would be wise to target their support of advisors’ portfolio construction needs. RIAs view asset managers as a resource in helping them to build their own models, while advisors in the Independent channel would likely appreciate education about fully outsourced models. Meanwhile, for National wirehouse firms using home office models, asset managers should seek to engage home office gatekeepers to secure their place in the lineup.

Click below to learn more about the full Advisor Brandscape report.