In December 2019, Escalent acquired Javelin Strategy & Research, a research-based advisory firm with deep expertise in the digital financial ecosystem, to become an even more formidable player in the financial services space. Thanks to Ian Benton, senior analyst in Javelin Strategy & Research’s Digital Banking practice, for these insights!

Small businesses have been hit hard over the past four months. As they reopen their doors, most are still struggling with a multitude of challenges, including reestablishing business with a tentative customer base, rethinking how payments are made and goods delivered, investing in changes to the physical environment, and navigating PPP loan repayment and forgiveness. There’s tremendous opportunity for banks to provide support throughout this process.

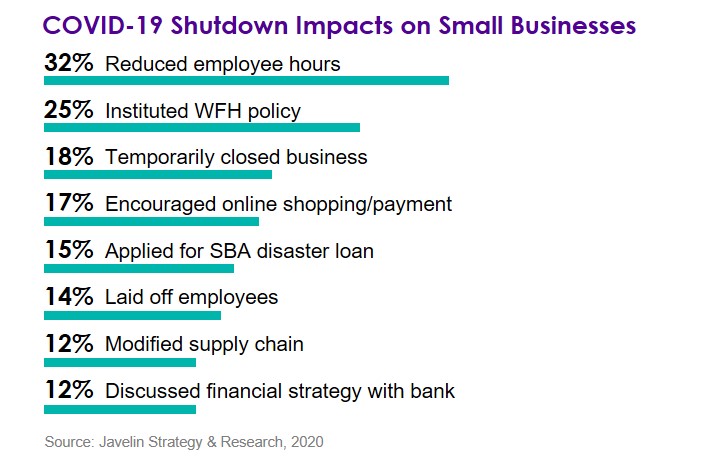

Javelin conducted three surveys to take the pulse of the small business community: the first in mid-March before the COVID-19 shutdown, the second in late March as the shutdown began, and the third in late April and early May as the shutdown continued. Unsurprisingly, three-quarters of small businesses reported they have been negatively affected by the shutdown. Nearly one-third (32%) were forced to reduce employee hours, 18% temporarily closed, and 12% discussed financial strategies with their bank.

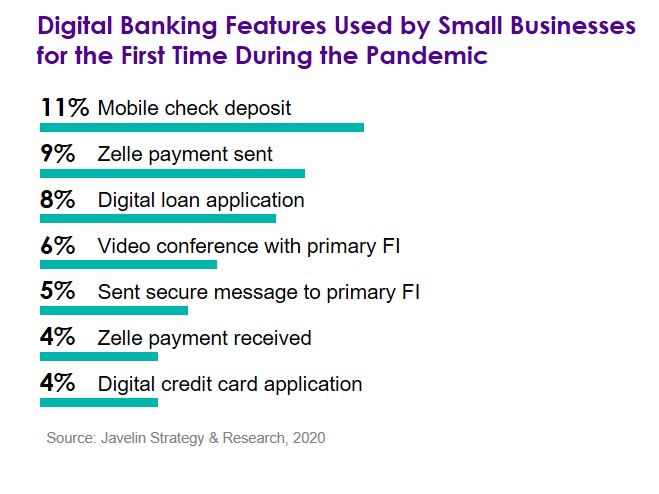

Like the rest of the country, small businesses have looked for ways to move their everyday operations from brick-and-mortar locations to online. One-quarter instituted work-from-home policies and 17% actively encouraged their customer base to switch to online shopping and payment. But the move to digital wasn’t just focused on customers. As banks were also forced to close their branches, small businesses turned to digital banking features. In fact, weekly mobile banking use nearly doubled, from 16% before the pandemic to 28% during the shutdown. And 11% of businesses reported using mobile check deposit for the first time.

Although many states have lifted restrictions and allowed businesses to reopen, the growing number of positive COVID-19 cases in the US doesn’t paint a positive picture for the future. Banks have an opportunity to continue to support their business clients in a number of ways as clients navigate an uncertain second half of the year.

That will include:

- Prioritizing digital features that proactively address business financial management needs, such as assistance with cash-flow analysis and projection and short-term financing in times of need.

- Helping businesses and independent contractors accept remote payments via Zelle.

- Ensuring PPP borrowers are aware of ongoing funds use and loan forgiveness requirements, the upcoming August 8 deadline for new loan origination, and developments in Washington relating to additional funds availability.

- Building on internal momentum from the initial PPP push to invest in digital application processes for other products.

Javelin is also sharing data and insight in Escalent’s Financial Service COVID-19 Market Research Perspectives. Click below to read all thirteen volumes to date!