As the COVID-19 crisis wears on, mass vaccination efforts have aided the reopening of local businesses and reawakened dormant industries. With that, the majority of advisors and nearly half of affluent investors now state they are confident current US economic conditions will improve in the next three months. But as the market uncertainties spurred by the COVID-19 pandemic become less top of mind, we are starting to see a new set of factors influencing perceptions of the current environment. In particular, a number of economic indicators have jumped to the forefront of financial advisors’ minds, signaling their continued concern for their clients’ investments and financial health.

While just 20% of advisors are satisfied with the current US economy, the majority (66%) are optimistic conditions will improve over the next three months, with just 18% predicting conditions will worsen. Meanwhile, fewer than half (47%) of affluent investors think the US economy will improve in the next three months and 26% predict conditions will worsen. However, there is a notable distinction in affluent investor confidence by age and by their advised status—meaning, whether they have an existing relationship with a financial advisor.

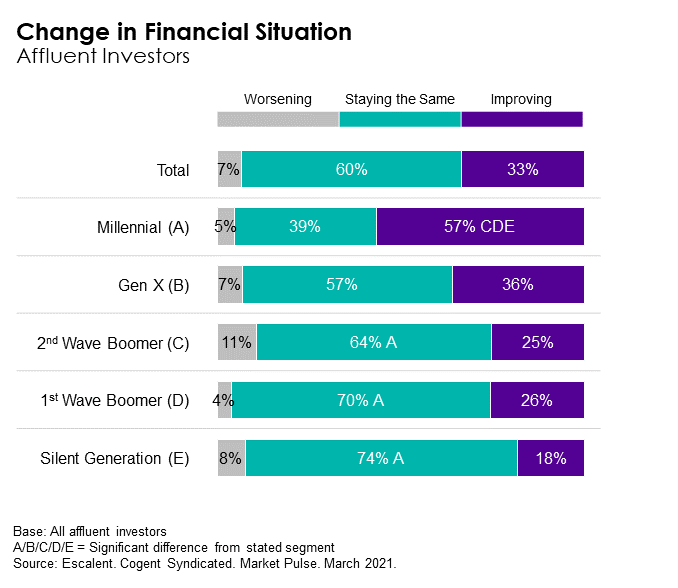

At this stage in the pandemic, the majority of affluent investors (60%) believe their financial situation is steady and showing no change, and one-third (33%) believe their financial situation is improving. Notably, more than half of Millennial investors think their financial situation is improving, significantly more so than their 1st and 2nd Wave Boomer and Silent Generation peers. Contributing to their optimism and bullishness, two-thirds (67%) of Millennial investors predict the US economy will improve in the next three months, with only 15% expecting it will worsen. Similarly, advised affluent investors are significantly more satisfied than their unadvised peers with the way things are going in the United States at this time (24% and 14%, respectively), and more than half (52%) of advised affluent investors predict US economic conditions will improve, compared with just 37% of non-advised affluent investors.

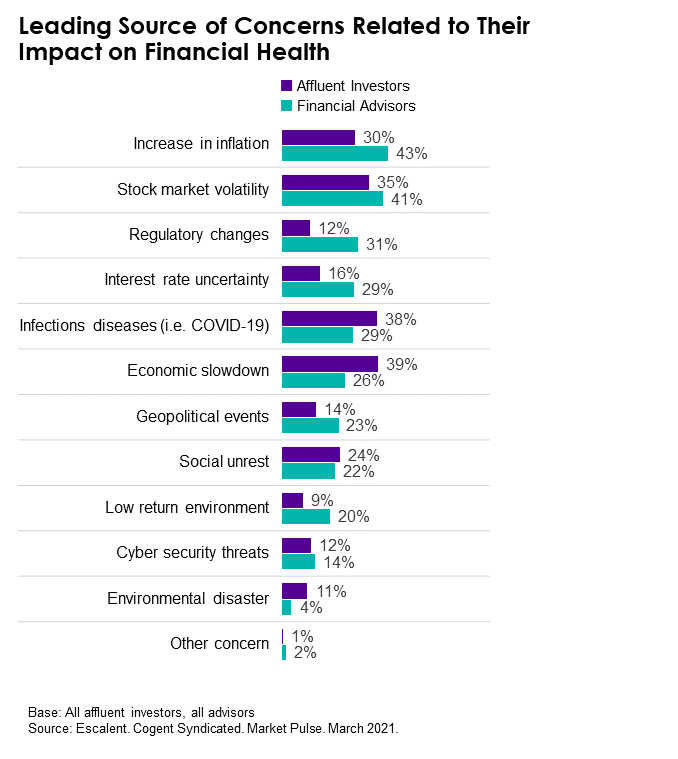

Last year COVID-19 commanded the attention of advisors and investors, but as we continue to work toward a global recovery, a handful of formidable new obstacles have captured their attention. An increase in inflation and stock market volatility are the leading concerns of financial advisors, followed by regulatory changes and interest rate uncertainty. Specifically, the shift in political control in the United States has influenced advisor fears relating to the US economy and GDP. Advisors cite government debt and spending, high interest rates, new tax regulations and inflation as the leading factors contributing to their concern about the future economic recovery of the US and their clients’ investments and financial health. While overall cybersecurity threats rank at the bottom of advisors’ leading concerns, it’s important to point out that advisors over the age of 65 are significantly more concerned than their younger peers about potential cybersecurity threats or data breaches.

Meanwhile, affluent investors are still very much feeling pandemic-related fears. An economic slowdown and COVID-19 continue to be the leading causes of concern for affluent investors when it comes to the US economy and their individual investment health. Throughout the pandemic, advisors have been reassuring clients about their financial concerns, which is likely why advised affluent investors feel more confident about the future of the economy than their unadvised peers. It is interesting, however, that although advised investors state they are feeling confident about a financial rebound, they have more concentrated fears around a potential economic slowdown and stock market volatility as it relates to their investments than their peers without a financial advisor, who tend to have a more diverse set of concerns (for example, cybersecurity or geopolitical events). Investment concerns also vary by generation, with Millennial affluent investors less concerned about future stock market volatility, and volatility being both the leading fear among Gen X affluent investors and the second highest concern among 1st and 2nd Wave Boomers, after COVID-19-related impacts.

With constantly evolving information regarding the US economic recovery and vaccines’ prowess, advisors are challenged to keep up with the rapidly changing environment. Advisors have a significant influence on their clients’ confidence, and asset managers and advisory firms can help to improve affluent investor optimism by providing client-ready educational materials that address the leading concerns among retail investors, in particular concerns of affluent investors in or approaching retirement who may feel some uncertainty about the stability and future recovery of the economy and stock market.

Each month we’re asking investors and advisors about the newest emerging trends in the wealth management space. Have something you want to ask these audiences? Send us a note!